Published April 10, 2018

On Monday, the Congressional Budget Office released its annual “Budget and Economic Outlook,” which offers projections about spending, revenues, deficits, and debt for the next ten years.

Although it’s not about porn stars and hush money, the report is really worth your time. It nicely summarizes what should be obvious to all: the Republican Congress and president do not seem to care about deficits or debt, and are not only failing to take steps to address the government’s poor fiscal situation but are taking steps likely to worsen it some. If numbers like these were to be published while a Democratic Congress and president were in office, they would be taken by many of us on the right as a blaring alarm and a strong reason to worry. We should take them precisely that way now; there is no excuse for doing otherwise.

First the basics. Even using its standard fiscal scenario (which assumes that expiring tax and spending provisions will be allowed to expire and that we will have far fewer emergency spending requirements in the future than in the past), CBO expects that the federal deficit will approach a trillion dollars next year and then will exceed a trillion dollars in every subsequent year over the coming decade (and beyond). The result will be $13 trillion of additional debt over the next ten years. We will achieve levels of debt, relative to the size of the economy, not seen since the Second World War—when we had a much better reason for them, and when there was a serious prospect of significantly paying down the debt (as the federal government indeed ended up doing). There is no such reason and no such prospect now.

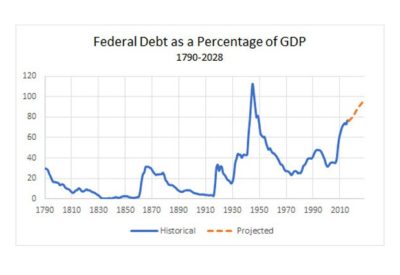

Here’s a quick chart, using OMB’s historical data and CBO’s 10-year projection, of how our situation looks in historical perspective. We are approaching the levels of debt our government reached in fighting WWII but without a mass mobilization, and with a relatively strong economy.

And remember, these are the more optimistic projections, which assume our elected officials are going to be more responsible over the next decade t

han they have been in the past. That probably won’t happen. As the report describes it:

If a combination of those changes to current law was made so as to maintain major policies that are currently in place and also to provide more typical levels of funding for emergencies, far larger deficits and much greater debt would result than are shown in CBO’s current baseline. Relative to the baseline projections for the 2019–2028 period, deficits would be larger by a total of $2.6 trillion (including debt-service costs), causing cumulative deficits of nearly $15 trillion over that period… Debt held by the public would reach about 105 percent of GDP by the end of 2028—the largest share since 1946—and would rise even more sharply in subsequent decades.

That last point is key. CBO sees these trends continuing beyond its 10-year budget window, because they are a function of both demographic trends and policy arrangements that tend to lock certain spending patterns in place. These trends have already transformed the character of federal spending in recent decades, and will continue to do so.

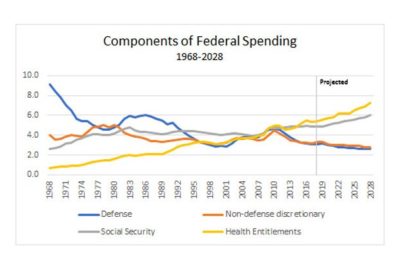

Here’s a breakdown of how the basic elements of federal spending (excluding interest on the debt) have changed over the past 50 years, and CBO’s projection for the coming decade. CBO doesn’t produce this chart, but I’ve made it from the data underlying their report (which can be found here).

What you see is not a huge break between ongoing trends and projected ones but a longstanding trend: Relative to the size of the economy, defense spending has declined sharply, domestic-discretionary spending has remained essentially flat, Social Security spending has increased significantly, and health-care spending has exploded.

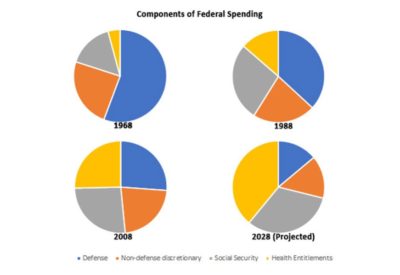

Here’s an easier way to see that pattern. This is how federal spending was divided among these four broad categories in 1968, 1988, 2008, and what CBO projects for 2028.

What we see here is entitlement spending eating up discretionary spending. And given the nature of our entitlement programs it is also, in effect, spending on the present eating up spending on the future. Social Security is spent almost entirely on the elderly. The health-care entitlements are spent largely on the elderly too (though to a relatively lesser degree of course). Our national government increasingly looks like a pension and insurance provider that runs a navy on the side. And its commitments are unsustainable beyond the medium term. Entitlement spending is outrunning the resources available to fund it and is growing faster than tax revenue could grow under any plausible scenario.

This is not a cause for panic, but it is a cause for worry. We’re an extremely wealthy society and have some room to make poor choices. But on the path we’re on, debt will gradually continue to constrain the options available to our government and to burden the rising generation—funding spending on the baby boomers in their later years in ways that do not much benefit the rising generation while weakening the capacity of our government to fund similar spending on that generation as it ages or to fund other priorities. The boomers are breaking the inter-generational compact, as they have broken so much throughout American society over their life cycle, and it will be up to those who follow them to clean up the mess and set things in better order.

That can be done in an endurable and sustainable way, but it will take a willingness to move beyond the Great Society welfare state, and especially (or rather, most challengingly) when it comes to the old-age entitlement system. In the cases of both Social Security and Medicare, we should aim to gradually move toward an approach to old-age social insurance that provides a modest universal benefit topped with means tested benefits (based on lifetime earnings) above that and coupled with stronger incentives for personal savings. Andrew Biggs has laid out what this would look like in the case of Social Security and Jim Capretta has more recently done so regarding Medicare. Their two proposals follow the same basic logic, and are designed for a slow, gradual transition over a long period to make the change politically palatable and economically reasonable.

As Capretta notes about Medicare, conservatives need to see that too much time has passed without action to still pursue only the relatively mild consumer-driven reforms that have been at the core of our approach for many years. If such reforms had been enacted even when there seemed to be some political will for them at the beginning of this decade, they could have significantly diminished the burden we will face in the years to come. But that did not happen. “If there was a window of opportunity during which enacting premium support might have addressed the core of Medicare’s long-term fiscal challenge, that time is behind us,” he notes. And the time that is ahead of us will require rethinking the basic logic of what these programs are for, in ways that leave today’s seniors and many of today’s workers in the old system while helping younger workers adjust to the benefits and burdens of a new approach premised on the principle that most help should go to those who need help most.

We can do this. It’s neither impossible nor unreasonable. And it is not a cause for panic. But it requires us to take the problem seriously, to pay attention to it, and to think responsibly about tradeoffs.

That obviously doesn’t sound like what our politics is all about right now. It won’t happen in the Trump era, it seems. But let’s hope it can happen in the post-Trump era. To ignore this problem is to needlessly make it much worse.

— Yuval Levin is the editor of National Affairs and a fellow at the Ethics and Public Policy Center.