Published June 18, 2024

In June 2022, the Supreme Court handed down its decision in Dobbs v. Jackson Women’s Health Organization, correctly finding that the Constitution did not contain a right to abortion. In the two years since, states have been passing laws to protect the unborn child in the womb—and create a society in which pregnant women, and the babies they carry, receive the support they are due.

In the two years since Dobbs, every state that has laws on the books protecting life in the womb has passed laws that expand support for pregnant and new moms and their babies; some to the tune of tens of millions of dollars annually. “Two Years After Dobbs,” a new report from scholars in EPPC’s Life and Family Initiative, showcases many of these essential, life-saving steps that can make welcoming a new life less daunting.

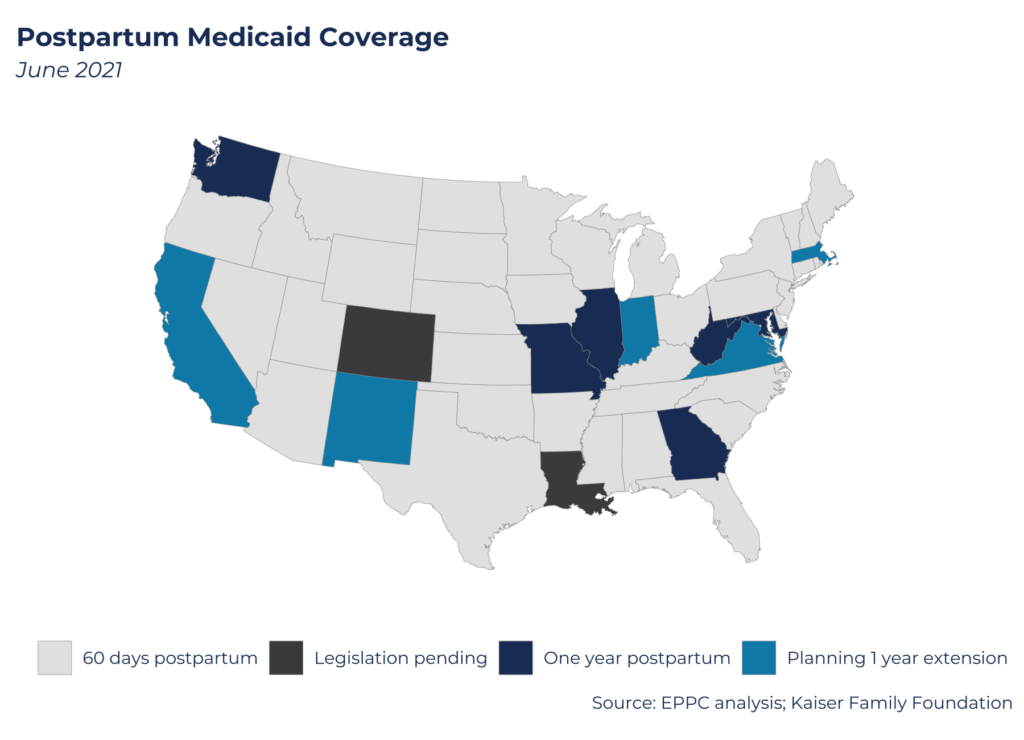

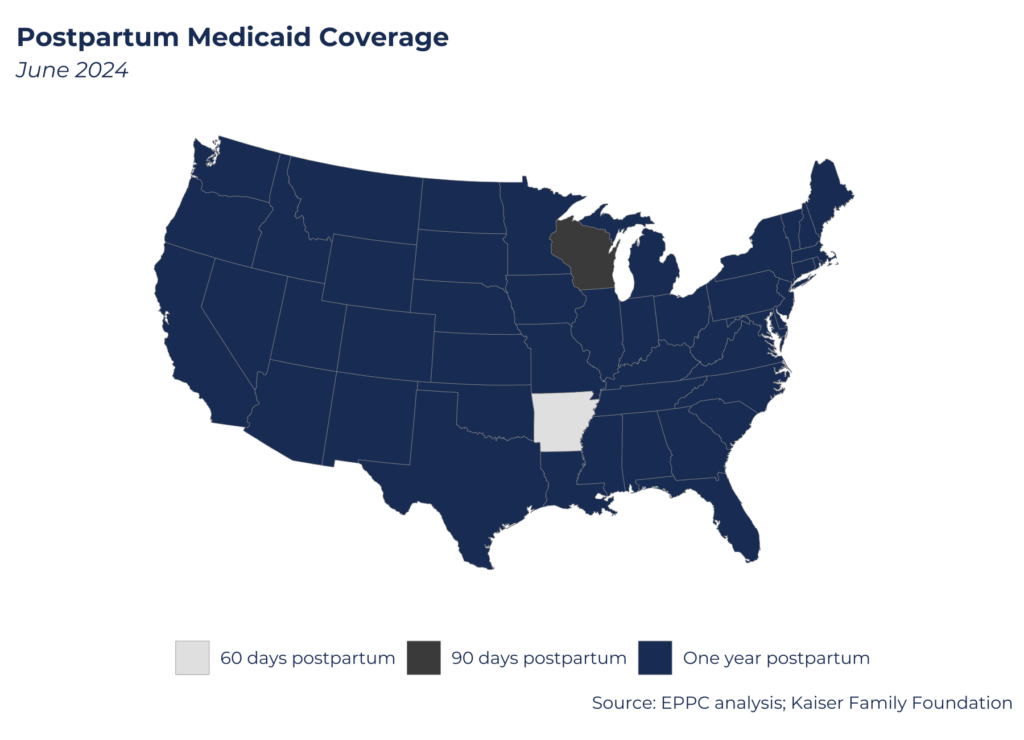

Every state, save one, has opted into expanding Medicaid coverage for postpartum women for up to a year after childbirth. Most states have taken steps to expand options for child care, or increased availability of health services for women. And a number of states have expanded eligibility for safety-net programs or provide direct aid to pregnant and new moms.

Building an authentically pro-life America will take years. But states can buttress the irreplaceable work of charities, churches, and non-profits by investing in programs that support moms during pregnancy, make life a little easier for families, and ensure young children get the healthy start they need. “Two Years After Dobbs” underscores that while more needs to be done, states are taking the lead in enacting laws that both protect and meaningful support the unborn, their moms, and their families.

Introduction

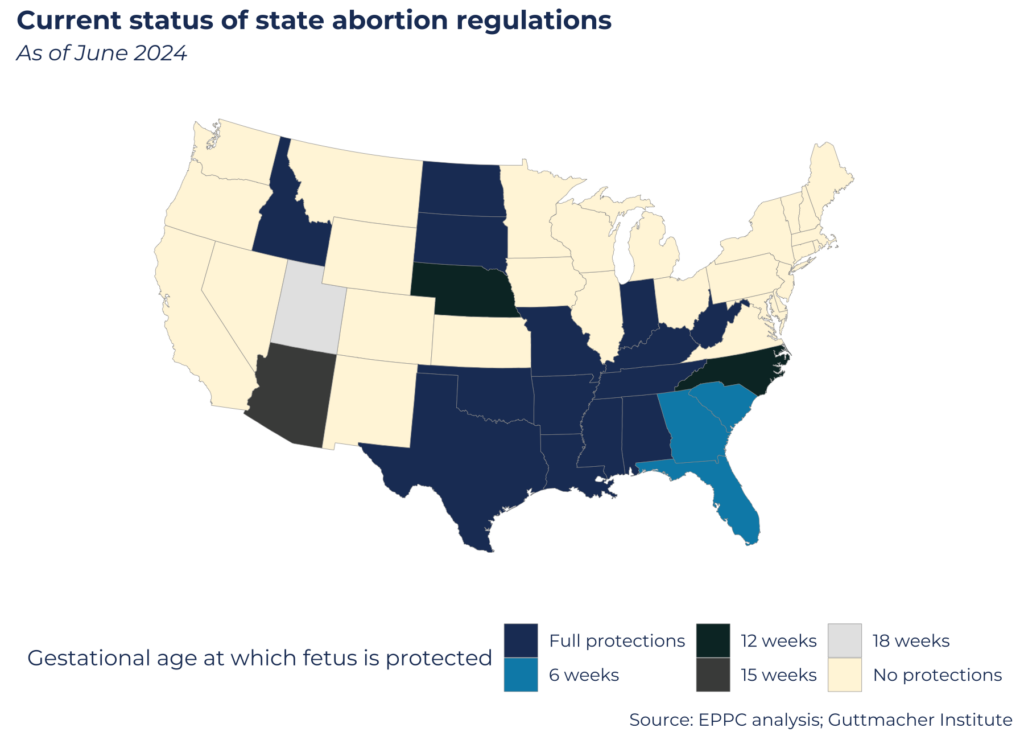

In the two years since the Supreme Court handed down its decision in Dobbs v. Jackson Women’s Health Organization, much has changed. As of this writing, 14 states now fully protect unborn children in most cases, save for when the life of the mother is in danger or other common-sense exceptions. Another seven states have passed protections for the unborn that would not have been permissible under the Roe v. Wade framework, with legal barriers to the procedure variously set at 6, 8, 12, 15 or 18 weeks.[1]

And while the exact impact of the Dobbs decision on abortion and birth rates remains uncertain—some studies suggest abortion rates ticked up after the Supreme Court’s decision, driven by greater prevalence of self-induced chemical abortions[2]—one thing is clear. An America in which unborn life is protected and abortion restricted is a nation in which more women and their children will be in need of material support.

For years, pregnancy resource centers, faith-based charities, and other non-profit organizations have walked with women facing unexpected or unwanted pregnancies—according to a leading pro-life research center, these groups provided $367 million worth of goods and services to pregnant moms and families in 2022 alone.[3]

But the pro-life movement cannot rely solely on the heroic work of these centers and charities to address the complex and multi-dimensional needs of moms facing crisis pregnancies. The work of civil society can be buttressed, even catalyzed, by strategic investments of public dollars. Pregnant women must know they are supported by a whole-of-society response—for their sake and the sake of the unborn lives they carry.

This research brief is meant to highlight the investments state governments have already begun to make in order to better accompany pregnant women and ensure they and their families have a healthy start.

In the two years since Dobbs, every state that has laws on the books protecting life in the womb has passed laws that expand support for pregnant and new moms and their babies, some to the tune of tens of millions of dollars annually. The policies highlighted in this report are essential, life-saving steps to make welcoming a new life less daunting.

Status of Postpartum Medicaid Coverage

This report focuses on the 21 states that currently have abortion restrictions that would have not been permitted under the Roe regime, plus Iowa and Ohio, which have both been the subject of much attention in the two years since Dobbs. This report finds that:

- 22 of these 23 states have extended Medicaid coverage, increasing the length of time a postpartum woman receives medical care from 60 days to one year

- 16 states took direct action to expand child care choices, from expanding subsidies to streamlining regulatory barriers for child care providers

- 14 states introduced or expanded programs that provide targeted, material assistance to pregnant women, whether directly or by working through pregnancy resource centers

- 13 states increased eligibility for safety net services, from expanding income eligibility thresholds for assistance to eliminating benefit caps based on family size

- 11 states acted to expand access to or coverage of health services for women, such as mammograms or screening for postpartum depression

- 9 states introduced or expanded paid parental leave for state employees, on top of the many states that had already done so prior to the Dobbs decision

This report is by no means comprehensive; many governors and state agencies shifted priorities in a more pro-family direction in ways that aren’t captured in this document. It largely omits the many changes made in the domain of child welfare and foster care, which, though essential for many children, are less relevant to the majority of children who are not involved in the foster system. It also does not include legislative proposals that were made by state leaders but failed to pass the legislature or were vetoed by a governor. It also does not include steps passed prior to 2022 to support pregnant women, babies, and families. And while we as scholars do not necessarily endorse each policy or approach that was passed, it is important to account for the wide scope of approaches to supporting mothers, parents, and families that states have been advancing.

Other important steps that can make family life affordable in general, such as cutting individual tax rates or loosening zoning regulations to help reduce the cost of housing, were left out in the interest of focusing on legislation aimed at the burdens that face parents and families specifically. And there are other states not included in this report that passed legislation aimed at supporting households with children present.

State officials should not and cannot rest on their laurels. Policymakers should carefully monitor the programs that have been introduced or expanded to measure their effectiveness and continue to explore new and more effective ways of helping new moms and families welcome a new child. Prioritizing the cause of life should lead to new approaches to safety-net programs, strategic investments in child care, housing affordability, and the other dimensions of economically supporting families.

At times this will require additional spending; at times it will require fresh approaches. Take child care, which is essential for a single mother to be able to provide for herself and her new child. It can be made more affordable by increasing subsidies, as well as by reducing regulatory burdens to allow more firms to enter the market and give parents more options.

In states across the U.S., state legislators continue to push the envelope with policy proposals that would, if passed, make it more affordable to have a child, make starting a family more achievable, and make the idea of welcoming an unplanned pregnancy a little less daunting for countless parents. We hope that future editions of this report will feature ever-bolder efforts to provide support for pregnant moms and strengthen healthy families.

Alabama

- HB358 (2024) allows employers to claim a tax credit against certain childcare expenses for 75% of eligible expenses incurred by the employer, or for 100% for small businesses, up to $600,000 per year per employer.

- HB 141 (2023) empowers private insurers to be able to offer paid family leave benefits in the state

- SB 106 (2022) expands postpartum Medicaid coverage from 60 days to one year after childbirth

Arizona

- SB 1601 (2023) requires insurers to provide coverage for a mammogram and digital breast scan at the age and intervals recommended by the National Comprehensive Cancer Network (NCCN)

- HB 2863 (2022) expands postpartum Medicaid coverage from 60 days to one year after childbirth

- SB 1726 (2023) raises the income eligibility for Arizona KidsCare from 200% to 225% of the federal poverty level

Arkansas

- Executive Order 24-03 (2024) establishes Arkansas Strategic Committee for Maternal Health, which will develop a plan to improve women’s health around prenatal and postpartum services

- Federal Waiver (2024) to makes child-care workers and foster parents, regardless of income, eligible for federal Child Care Assistance program funds

- HB 1035 (2023) requires screening for depression of birth mothers at the time of birth and mandates that insurance policies cover screening for depression of birth mothers at the time of birth.

- HB 1155 (2023) prevents local authorities from imposing additional zoning regulations on home-based child-care facilities

- HB 1161 (2023) requires public and charter schools to support pregnant and parenting students by excusing related absences, providing accommodations for nursing, and ensuring that students are not penalized for these protections

- SB 286 (2023) allocates $1 million in grants to organizations that provide material support and other assistance to individuals facing an unintended pregnancy to help those individuals give birth to their unborn children

- SB 426 (2023) extends paid maternity leave for state employees to twelve weeks, including childbirth, adoption, and foster placement of an infant

- SB 465 (2023) improves administration of the Life Choices Lifeline program, which connects pregnant women with housing assistance, job training, medical care, and other services

- SB 102 (2022) allocates $1 million in grants to organizations that provide material support and other assistance to individuals facing an unintended pregnancy to help those individuals give birth to their unborn children

Florida

- HB 415 (2024) creates a new state website that will provide educational materials on pregnancy and parenting, educational, and mentorship programs for fathers, financial assistance, and adoption services

- HB 1267 (2024) introduces a new Temporary Assistance for Needy Families case management system to help families avoid benefit cliffs in housing and child-care subsidies

- HB 121 (2023) expands eligibility for the Florida Kidcare children’s health insurance program from children in families with incomes up to 200% of the federal poverty line (FPL) to 300% of FPL

- SB 300 (2023) allocates $25 million to the Florida Pregnancy Care Network, Inc., which is tasked with providing direct services, such as pregnancy testing, counseling, referrals, nonmedical material assistance such as clothing, car seats, cribs, formula, and diapers, and mentoring and education regarding pregnancy, parenting, and life skills

- HB 7065 (2022) encourages responsible and involved fatherhood through mentorship programs, engaging fathers in certain prenatal and infant health programs, and developing programs to increase fathers’ ability to pay child support

Georgia

- HB 1010 (2024) expands the allowable paid parental leave for state employees following childbirth or adoption or foster-care placement from three to six weeks

- HB 1046 (2024) creates the Georgia Commission on Maternal and Infant Health to make policy recommendations about improving perinatal care and reducing maternal mortality

- SB 106 (2023) establishes a three-year pilot program to provide coverage for remote maternal health clinical services under Medicaid

- HB 129 (2023) expands eligibility for the Temporary Assistance for Needy Families (TANF) program to women who are currently pregnant but do not yet have children

- SB 116 (2022) standardizes regulation of maternity homes and prohibits local government from constraining the establishment or operation of such residences

- SB 338 (2022) expands postpartum Medicaid coverage from six months to one year after childbirth

Idaho

- HB 543 (2024) prohibits homeowners associations from adding restrictions which would prohibit the operation of an in-home family daycare

- HB 633 (2024) expands postpartum Medicaid coverage from 60 days to one year after childbirth

- HB 288 (2023) increases the individual state tax deduction for dependent care, including child care and care for dependents with disabilities, to up to $12,000 per year

- SB 1270 (2022) requires medical providers to provide an up-to-date, evidence-based fact sheet listing information, therapies, and resources available to parents whose unborn child tests positive for Down syndrome

Indiana

- HB 1001 (2023) expands to $3,000 the dependent exemption in the first year a parent can claim a child, creates a tax credit of 50% of an employer’s child-care expenses (up to $100,000), expands eligibility for Indiana’s early education grant program from families in households up to 127% of FPL to 150%, and establishes the Commission on Improving the Status of Children

- HB 1138 (2023) increases standards on drinking water in preschool and child-care facilities, and requires owner/operators to eliminate lead if it surpasses a given level

- HB 1290 (2023) increases the state’s Earned Income Tax Credit amount from 10% to 12% of the federal amount that an individual can claim and recouples eligibility to the federal level

- HB 1009 (2023) amends child support regulations to require that fathers pay at least 50% of expenses associated with the mother’s pregnancy and childbirth, including prenatal care, delivery, and postpartum expenses

- SB 265 (2023) expands eligibility for the TANF program to include women who are pregnant at the time of application, expands the income eligibility threshold up to 50% of FPL (by 2028), increases the maximum allowable TANF payments by 160%, and eliminates procedures that prevented moms for having babies while on public assistance from receiving additional benefits (the so-called “family cap”)

- HB 1361 (2022) increases the asset limit for TANF eligibility, allowing more low-income families to be eligible for cash assistance or child care vouchers

- HB 1140 (2022) increases eligibility for Medicaid coverage for pregnant women from 200% to 208% of FPL, and extends coverage from 60 days to one year after childbirth

- SB 2 (2022) establishes the Hoosier Families First Fund, and appropriates $45 million to expand access to child care, newborn safety devices, home visiting programs, long-acting reversible contraceptives, and provide more funding to foster and adoptive families

Iowa

- HF 2276 (2024) requires all cities and localities to treat maternity homes as a permitted use in all residential zones or district, and prohibits any special permits or variances for its operation

- HF 2489 (2024) requires all health insurers to cover mammograms and diagnostic breast exams

- SF 2251 (2024) expands postpartum Medicaid coverage from 60 days to one year after birth, and reduces eligibility for coverage from 300% to 215% of FPL

- SF 2252 (2024) amends the More Options for Maternal Support program to allow it to be administered directly thorough the state department of Health and Human Services

- HF 265 (2023) establishes licensing standards for the practice of midwifery

- HB 707 (2023) increases the maximum income eligibility threshold for state-funded child care assistance from 145 percent of the federal poverty level to 160 percent and increases reimbursement rates to participating providers

- SF 561 (2023) establishes the state-funded family medicine obstetrics fellowship fund, allowing four fellows to be trained in maternal and family medicine in Iowa, and increases the funding for the More Options for Maternal Support (MOMS) Program to $1 million

- HF 2578 (2022) appropriates $500,000 to establish the More Options for Maternal Support (MOMS) Program, ensuring access to quality prenatal and postpartum care, providing pregnancy support services, and assisting women to practice sound health-related behaviors throughout their pregnancies and after delivery so their babies can thrive

- HF 2252 (2022) eliminates a time restriction on child-care assistance when a parent is hospitalized or suffers physical or mental illness

- HF 2564 (2022) creates a new child-care tax credit for employers that claim the federal employer-provided child care tax credit

- SF 2367 (2022) eliminates sales and use taxes from the sale of feminine hygiene products and child and adult diapers

Kentucky

- HB 10 (2024) establishes Kentucky Lifeline for Moms maternal psychiatry access program; creates Kentucky maternal and infant health collaborative to improve perinatal health; establishes voluntary statewide home visiting program, “Health Access Nurturing Development Services” (HANDS); allows women to enroll for health insurance outside of the normal enrollment periods; requires that health insurers cover maternity-related care and breastfeeding services and supplies; allows for Medicaid eligibility to be expanded under certain circumstances; covers maternity coverage under the Kentucky Children’s Health Insurance Program and requires contracted managed care organizations to cover maternity benefits under Medicaid; and requires the Cabinet for Health and Family Services to study doula certification programs, among other provisions

- HB 115 (2024) requires state-sponsored health insurance plans to cover mammograms and diagnostic breast exams at no cost to the user

- HB 561 (2024) establishes a Certified Child Care Community Designation Program to increase supply of child care by local programing and zoning reform

- HB 499 (2022) establishes the Employee Child Care Assistance Partnership, allocating $15 million to match employer contributions to employees’ child-care costs

- HB 708 (2022) establishes a basic health program for low-income individuals, and instructs state agencies to develop and introduce a “benefits cliff” calculator to reflect eligibility for safety-net programs

Louisiana

- SB 55 (2024) requires hospitals and birthing centers to provide information regarding post-birth warning signs to new mothers and their families upon discharge

- SB 278 (2024) creates the Louisiana Pregnancy and Baby Care Initiative within the Department 4 of Children and Family Services, replacing the state’s prior Alternatives to Abortion program and rolling over its $1 million in contracts with providers aimed at offering pregnancy support, parenting help, and adoption assistance

- HB 5 (2023) allows the biological mother of a child to recover 50% of documented out-of-pocket medical expenses related to pregnancy and childbirth from the child’s biological father

- HB 21 (2023) allows public school systems to extend an additional 30 days of sick leave for pregnancy-related illness or other required medical visits on top of the initial 90 days already provided to them

- HB 272 (2023) requires health insurers to provide maternity benefits that include maternity support services provided by a doula

- HB 282 (2023) ensures that K–12 students who qualify for reduced-price meals shall be provided breakfast and lunch at no cost to the student or their family

- SB 135 (2023) provides that the Louisiana Department of Health will reimburse licensed midwives or certified nurse midwives for providing pregnancy and childbirth services at a level that is at least 95% of the amount reimbursed to licensed physicians

- HR 193 (2022) requests the Louisiana Department of Health submit a federal waiver to allow postpartum Medicaid coverage from 60 days to twelve months post-partum

- HB 406 (2022) establishes the Early Childhood Supports and Services Program Fund, and allocates $40 million to help advance its work of building local, integrated, and comprehensive systems of care and healthy development for young children

- HB 516 (2022) requires public high schools to adopt policies regarding attendance, provide breastfeeding accommodations, and provide child-care information for students who are pregnant or parenting.

- HB 909 (2022) creates a new continuum of care program with the Department of Chilren and Family Services and allocates $2 million to help encourage healthy childbirth, promote family formation, assist with successful parenting techniques, and increases families’ economic self-sufficiency

- SB 116 (2022) creates a new office on women’s health within the Department of Health to lead, and coordinate efforts to improve women’s health outcomes through policy, education, evidence-based practices, programs, and services

- SB 85 (2022) creates a new checkbox to allow taxpayers the option of donating a portion of their state income tax refunds to Maddie’s Footprints, a charitable organization that supports parents who have experienced loss by miscarriage, stillbirth, or the death of an infant

Mississippi

- Launched (2024) Mississippi Access to Maternal Assistance (MAMA), a web portal with verified links to assistance for pregnant women, including health care, basic goods, job training, child care, and more

- HB 539 (2024) establishes presumptive eligibility for Medicaid coverage for pregnant women up to 60 days

- HB 1734 (2023) expands a 50% state income tax credit for employers that provide child care for their employees valued at $6,000 or more

- SB 2167 (2023) establishes a task force around early childhood, with the goal of recommending steps to increase access to services for children from birth to age three through a First Steps Early Intervention Program

- SB 2212 (2023) expands postpartum Medicaid coverage from 60 days to one year after childbirth

- SB 2696 (2023) allows a tax credit against the costs of qualified adoption expenses for $10,000 for each child residing in the state and $5,000 for children residing out of state

- SB 2781 (2023) instructs the state’s Department of Information Technology to develop and manage an app and website with information and services related to pregnancy, childbirth, child care, parenting skills, and other resources

Missouri

- HB 2011 (2024) allocates $3 million in federal TANF dollars for a healthy marriage and fatherhood initiative; assigns $8.6 million, of which $6.3 million is federal TANF dollars, for an alternatives to abortion program that includes the provision of material assistance like diapers; allocates a $2 million grant to promote adoptions, maternity homes, and organizations that provide material support for pregnant women; allocates $1 million for a grant to a non-profit that celebrates and supports black families during pregnancy (currently pending Governor’s signature)

- HB 11 (2023) allocates $2.5 million in federal TANF dollars for a healthy marriage and fatherhood initiative; assigns $8.6 million, of which $6.3 million is federal TANF dollars, for an alternatives to abortion program which includes the provision of material assistance like diapers

- SB 24 (2023) authorizes a nonrefundable $10,000 tax credit for adoption-related expenses

- SB 45 (2023) expands postpartum Medicaid coverage from 60 days to one year after childbirth

- SB 106 (2023) prohibits health insurers from requiring a referral or enacting cost-sharing for certain low-dose mammography screenings; introduces transitional benefits in certain circumstances for families whose income have increased such that they are losing their eligibility for TANF, SNAP, and child-care assistance; expands Medicaid coverage of low-income pregnant and postpartum women from 60 days after childbirth to one year; requires every medical provider must annually educate parents of young children regarding lead hazards and provide the option to test for lead poisoning, and more

- SJR 26 (2023) approves a constitutional amendment, subject to the approval of the voters, that exempts child-care facilities from property tax

- HB 3010 (2022) grants $11.5 million, of which $5.2 million are federal dollars, to the Division of Community and Public Health for family planning and pregnancy health-care services available to women whose income does not exceed 201% of FPL

- SB 683 (2022) creates the Office of Childhood within the Department of Elementary and Secondary Education; updates licensure requirements for child care facilities, including loosening some regulatory requirements for family child-care homes

Nebraska

- LB 840 (2024) establishes the Poverty Elimination Action Plan, which will create a comprehensive, statewide plan to increase access to job training, affordable housing, health care, child care, and other anti-poverty efforts

- LB 856 (2024) makes child care workers categorically eligible for the federal Child Care Assistance Program

- LB 857 (2024) creates the Nebraska Prenatal Plus program to provide services for Medicaid-eligible mothers at risk of an adverse birth outcome, including nutrition counseling, health education, breastfeeding support, and case management

- LB 874 (2024) modifies and streamlines aspects of child-care licensing

- LB 904 (2024) increases reimbursement rates for child-care providers and creates the Intergenerational Care Facility Incentive Grant program

- LB 227 (2023) provides for the review of incidents of severe maternal morbidity under the state’s Child and Maternal Death Review Act and expands postpartum Medicaid coverage from 60 days to six months after childbirth (later expanded to one year)

- LB 754 (2023) establishes two separate tax credits: a non-refundable tax credit for contributions to child-care providers (75% to 100% of the contribution up to $100,000) and a refundable tax credit for parents of young children with child-care expenses ($2,000 per child for households under $75,000, $1,000 per child if household income is between $75,000 and $150,000)

- LB 905 (2022) directs the state Board of Medicine to develop best practices that ensure new mothers are screened for maternal mental health disorders during prenatal and postnatal visits and may create a referral network to ensure referrals and potential follow-up

- LB 984 (2022) eliminates sales and use taxes on feminine hygiene products

North Carolina

- H 76 (2023) expands Medicaid coverage to all adults age 18-64 with incomes up to 133% of FPL and increases Medicaid reimbursement rates

- H 259 (2023) allocates $6.25 million to the Carolina Pregnancy Care Fellowship, which funds pregnancy centers, education, medical equipment and training; exempts breast pumps, including repair and replacement parts, and breast pump collection and storage supplies from sales tax; expands eight weeks of paid parental leave to all state employees to give birth, and four weeks of leave for fathers or adoptive or foster parents; increases the reimbursement rate in child-care subsidies, establishes a maximum fee participating families will pay if receiving child-care assistance, and establishes eligibility at 200% of FPL for children under six years old; appropriates $525,000 to establish a pilot program aimed at helping establish new in-home child-care programs; enhances child support collection; and establishes a pilot public/private partnership to explore a new funding model where child care costs are split equally between the employee, the employer, and the state, including both full- and part-time care, before- and after-school care, and summer camps

- S 20 (2023) increases the Medicaid rate for obstetrics maternal bundle payments; expands the practice authority of Certified Nurse Midwifes; appropriates funds to expand the Safe Sleep North Carolina Campaign and long-term birth control; increases the reimbursement rate for low-income children participating in child-care programs; appropriates $700,000 to the State Maternity Home Fund, increase kinship and foster-care reimbursement rates; and devotes $1.5 million to community college programs that assist students faced with hardships, like child-care expenses

- H 103 (2022) allocated $2.58 million to nonprofit pregnancy centers to serve pregnant moms across the state

North Dakota

- HB 1176 (2023) establishes an adoption income tax credit equal to 10% of the federal adoption credit (not to exceed 50% of the taxpayer’s tax liability); creates a tax credit for contributions made to a maternity home, pregnancy help center, or adoption agency of 100% of the amount of the donation (not to exceed $2,500 or 50% of the taxpayer’s tax liability)

- HB 1177 (2023) exempts children’s diapers from state sales taxes

- HB 1450 (2023) amends North Dakota’s anti-discrimination laws to clarify employers must make accommodations for pregnancy, childbirth, and related medical conditions

- HB 1540 (2023) amends the child-care assistance program to eliminate fees for families that have an income below 30% of the state median income; appropriates $62 million in grants for workforce development, direct assistance, and quality improvements

- SB 2012 (2023) expands eligibility for the children’s health insurance program from 175% of FPL to 210%; increases coverage of Medicaid in-home services for children with autism, and more

- SB 2081 (2023) removes the requirement for maternity homes to be licensed by the Department of Health and Human Services in order to operate

- SB 2129 (2023) directs the Department of Health and Human Services to establish an alternatives-to-abortion program that provides funding to nongovernmental organizations tasked with giving pregnant women information, counseling, support services, and material assistance

- SB 2181 (2023) increases eligibility for Medicaid coverage for pregnant women from 162% of PFL to 175% of FPL; makes all income-eligible pregnant women eligible for TANF, rather than only those in the third trimester; repeals a provision that prohibited an increase in benefits upon pregnancy (the so-called “family cap”); and extends Medicaid coverage from 60 days to one year postpartum

- SB 2182 (2023) excludes Department of Defense–certified child care programs from needing to be licensed by the state

- HB 1105 (2021) amends the state’s public indecency law to specify that a woman may breastfeed her child in any location, public or private, where she and her child are otherwise authorized to be

- HB 1205 (2021) establishes a state maternal mortality review committee, tasked with identifying ways to reduce pregnancy-related deaths and severe maternal morbidity

Oklahoma

- SB 538 (2024) amends the “Choosing Childbirth Act” to add obstetric ultrasounds, mental health and substance abuse services, and transportation assistance as reimbursable services

- SB 1125 (2024) appropriates $18 million to the Choosing Childbirth Revolving Fund

- SB 1739 (2024) eliminates licensing requirements for birthing centers and grants a wider scope of practice for certified nurse-midwifes and certified professional midwifes

- Approved federal waiver (2023) increases the income threshold for Medicaid eligibility for pregnant and postpartum women from 138% to 205%, and expands postpartum coverage from 60 days to one year after childbirth

- HB 1932 (2023) provides that a TANF applicant or recipient who is pregnant without minor children at home qualifies for the program

- HB 2452 (2023) streamlines regulations for in-home family child-care providers, ensuring localities cannot issue additional capacity requirements on top of state regulation

- SB 40x (2023) appropriates $2.5 million for child-care access, among other human service grants

- SB 1121 (2023) provides six weeks of paid maternity leave for public-school teachers

- HB 3088 (2022) creates a state income tax credit of up to 10% of adoption-related expenses (up to a maximum of $4,000 for joint filers or $2,000 for individuals)

- SB 1286 (2022) exempts child-care facilities certified by the Department of Defense from being subject to the Oklahoma Child Care Facilities Licensing Act

Ohio

- HB 34 (2024) permits a prospective juror who is a breastfeeding mother to be excused from jury service

- HB 33 (2023) creates the Department of Children and Youth to serve as the state’s primary children’s services agency, including adoption, child welfare, early education, child care, home visiting, maternal and infant health and support, and more; requires new funding for residential infant care for substance-exposed infants and their families; makes school breakfasts and lunches free to all students who would qualify for reduced-price lunches; requires schools with girls in grades 6–12 to provide free feminine hygiene products; requires the Department of Health to update its infant mortality scorecard in real time, rather than quarterly; exempts child-care programs that are operated by schools from certain licensing requirements and prohibits educational attainment requirements; increases income eligibility for state child-care assistance from 142% to 145% of FPL; requires the state Medicaid director to seek a Medicaid waiver to provide continuous enrollment for eligible children from birth to age three; exempts children’s diapers, wipes, car seats, cribs, and strollers from sales and use taxes; triples available paid parental leave to state employees to 12 weeks at 70% pay; and requires sports betting and casino operators to withhold child and spousal support from winnings

- Launched (2023) Comprehensive Maternal Care, a community-based partnership between the Ohio Department of Medicaid and local obstetrical practices aimed at reducing health disparities, conducting pregnancy risk assessments, and rewarding providers that address patient needs across pre- and post-natal care

- HB 371 (2022) requires health insurers to cover one screening mammogram every year and additional screening under certain conditions

South Carolina

- H4832 (2024) allows private insurers to sell policies that cover paid family leave in the state

- H3908 (2023) expands the state’s paid leave offerings to cover public-school employees

- S474 (2023) requires the biological father of a child to pay 50% of the mother’s pregnancy expenses and directs all health insurers to include coverage for contraceptives

- S11 (2022) introduces six weeks of paid maternal leave for state employees and two weeks of paid parental leave for dads and adoptive parents

South Dakota

- HB 1224 (2024) directs the state’s Department of Health to create a video and other material to explains the state’s abortion law, acts that do and do not constitute an abortion, and the criteria practitioners should consider when treating a pregnant woman facing potential life- or health-threatening complications resulting from pregnancy

- Administrative rulemaking (2023) by the state’s Bureau of Human Resources expands paid family leave for state employees from 60 percent of pay for eight weeks to full pay for twelve weeks

- SB 75 (2023) finds unmarried fathers responsible for reasonable expenses related to the mother’s pregnancy and prenatal care, labor and delivery, and postpartum treatment

- Established (2022) Life.SD.gov, a website portal with links to support for pregnant moms, resources on healthy pregnancy, parenting tips, applications for financial, child care, and nutrition assistance, and more

- SB 64 (2022) expands the state’s home visiting program, Bright Starts, to serve low-income mothers and their children statewide

Tennessee

- Federal Waiver (2024) to provide parents covered by TennCare a certain number of free diapers each month for children up to two years of age

- SJR 848 (2024) urges the state to develop a comprehensive statewide paid family caregiving policy and program

- HB 1545 (2023) appropriates funds to expand postpartum Medicaid coverage from 60 days to one year after childbirth

- SB 394 (2023) requires doula services offered by an individual certified by the Department of Health (DOH) be made available to TennCare recipients and establishes requirements that a doula must meet in order to receive certification

- SB 454 (2023) authorizes private insurers to offer policies to cover family leave benefits

- SB 543 (2023) creates the child-care improvement fund, which provides grants to nonprofits to expand child-care access

Texas

- Federal Waiver (2024) enables transition of Healthy Texas Women to a managed care delivery model and expands eligibility from 200% of FPL to 204.2% of FPL

- HB 1 (2023) allocates $140 million over to years to the program formerly known as Alternatives to Abortion; approves a 6% boost to Medicaid payment rates to improve children’s access to well visits and other clinical services; appropriates $221 million to community mental-health services for children

- HB 12 (2023) expands Medicaid coverage from six to twelve months postpartum

- HB 1575 (2023) introduces better screening for pregnant women’s medical and non–health-related needs; allows community health workers and doulas to be reimbursed for providing services that improve maternal health

- SB 24 (2023) consolidates various pregnancy and parenting support programs into the Family Support Services division and codifies the Texas Pregnancy and Parenting Support Network, which contracts with provides to provide health-care information and access, infant-care supplies, maternity home housing, child care and transportation benefit coordination, and more; establishes the Thriving Texas Families (TTF) program as a continuation of the Alternatives to Abortion program

- SB 379 (2023) exempts child and adult diapers, baby wipes, breast pumps, baby bottles, and feminine hygiene products from state sales and use taxes

- SB 1145 (2023) would amend current law to allow localities to exempt child-care facilities from property taxes (requires voter approval)

Utah

- HB 153 (2024) expands the child tax credit to cover children ages 1–4 and reduces licensing requirements for residential child-care providers

- HB 246 (2024) creates the Office of Families within the Department of Health and Human Services to develop initiatives that support the needs of families and children, advocate policies that strengthen the ability to create and form families, and evaluate the impact of policies on families

- SB 147 (2024) directs the state Department of Health and Human Services to provide or contract for pregnancy support services, including medical care, housing, child care, and nutrition assistance, parenting classes, material items, and other resources

- HB 170 (2023) enacts a nonrefundable child tax credit of $1,000 per child for families with children ages 1–3 and incomes under $27,000 (married filing separately), $43,000 (single or head of household), or $54,000 (joint filing); amount depreciates by 10 cents for every dollar a family is over these limits.

- HB 15 (2022) increases the number of children a residential child-care provider may care for; allows for certain state investment to expand child-care facilities

- SB 1033 (2023) directs the state Medicaid agency to extend postpartum coverage from 60 days to twelve months

West Virginia

- HB 2002 (2023) establishes the West Virginia Mothers and Babies Pregnancy Support Program, which subcontracts with organizations that provide material support and other assistance to pregnant women, and increases the adoption tax credit to $5,000, with the option of splitting it over up to three years

- HB 2515 (2023) requires that state agencies develop and maintain an inventory of available services and supports for low-income individuals looking to increase their education, secure workforce training, or reenter the workforce

- SB 468 (2022) creates a website clearinghouse with information to aid parents who are expecting a child diagnosed with Down syndrome or other disabilities

- SB 656 (2022) establishes a tax credit for employers who provide or sponsor child-care facilities for their employees in West Virginia, at 50% of the cost of operation to the employer (minus any employee-paid amount)

- SB 656 (2022) tax credit for employers who provide or sponsor child-care facilities for their employees in West Virginia, at 50% of the cost of operation to the employer (minus any employee-paid amount)

[1] Annette Choi and Devan Cole, “See where abortions are banned and legal — and where it’s still in limbo,” CNN, May 2, 2024, https://www.cnn.com/us/abortion-access-restrictions-bans-us-dg/index.html

[2] A study from the Society of Family Planning’s #WeCount self-reported data reports an increase in abortion post-Dobbs, but their methods and imputation have been criticized by other researchers. See https://doi.org/10.46621/218569qkgmbl

[3] “Pregnancy Centers Offer Hope for a New Generation,” Charlotte Lozier Institute, Care Net, Heartbeat International, and National Institute of Family and Life Advocates, May 2024, https://lozierinstitute.org/wp-content/uploads/2024/05/Pregnancy-Center-2024-Update.pdf

Patrick T. Brown is a fellow at the Ethics and Public Policy Center, where his work with the Life and Family Initiative focuses on developing a robust pro-family economic agenda and supporting families as the cornerstone of a healthy and flourishing society.