Published April 20, 2017

Kemp Forum on Exchange Rates and the Dollar

Click here to view a video of Mr. Mueller’s presentation. For more information on the Kemp Forum on Exchange Rates and the Dollar, click here.

(Click to expand images)

Thank you, Jimmy Kemp, for hosting, Steve Hanke for co-chairing, and Sean Rushton for organizing this Kemp Forum on Exchange Rates and the Dollar. As my identifying first slide indicates, I have been blessed to collaborate over the decades on this issue with not just one but two great men: the first being Jack Kemp, for whom I worked in Congress from 1979 to 1988 under both Reagan administrations, and the other, the man you just heard, Lewis E. Lehrman. I have done what I could to promote the efforts of the Jack Kemp Foundation, which Jimmy Kemp launched and now leads.

Perhaps I should say something about my role in Jack’s office. Over a period of almost ten years, every two weeks, Jack Kemp’s office in the Rayburn House Office Building turned for an afternoon into a sort of cross between a graduate seminar in economics at the University of Chicago and a kindergarten production of The Music Man, in which the actors shouted at one another, “He’s a fake and he doesn’t know the territory!” “Supply-siders” have always been notoriously argumentative, and it was my role to help Jack formulate and explain the economic ideas coherently and consistently. This was possible, of course, only if one could agree on what those ideas were. The task was made more difficult by the fact that supply-side economists couldn’t seem to agree on the simplest and most basic facts about the history of economics. I discovered the reason only years later, when I began to write my own book, which Jimmy mentioned.

Beginning in 1972, the University of Chicago’s economics department abolished what had previously been a degree requirement: that in order to earn a Ph.D., you had to have mastered the history of economics. All other economics departments in the country, as far as I can tell, soon followed that example. Perhaps the history of economics was already moribund. But by successfully campaigning for that change, George Stigler committed a deliberate act of amnesia among economists regarding exactly what economics is all about.

I mentioned the bi-weekly meetings resembling a kindergarten production of The Music Man. I was pressed into service to ride herd on the production, like a student who because of his height was made a teacher’s aide. I had to formulate a view on issues including exactly the ones we’ve been hearing about today. In the video you saw a few minutes ago, Lew Lehrman spoke of the “twin evils” of exchange-rate instability and the official reserve currency role of the dollar. I’d like to speak about the second, and specifically about “The Triffin Dilemma.” I brought my copy of the transcript of the 1983 conference, which was published as “A Monetary Agenda for World Growth.” As several others have mentioned, the “Pre-Williamsburg” conference 34 years ago had a truly all-star cast, co-chaired by then-Congressman Jack Kemp and Columbia University economist Robert A. Mundell, but also including Arthur Laffer, then-Secretary of State George Schultz, and Robert Triffin, the eponymous Belgian-American descriptor of “The Triffin Dilemma”–among many others.

I’d like to mention three consequences of the choice of a monetary standard: for the federal budget, the general price level, and international payments.

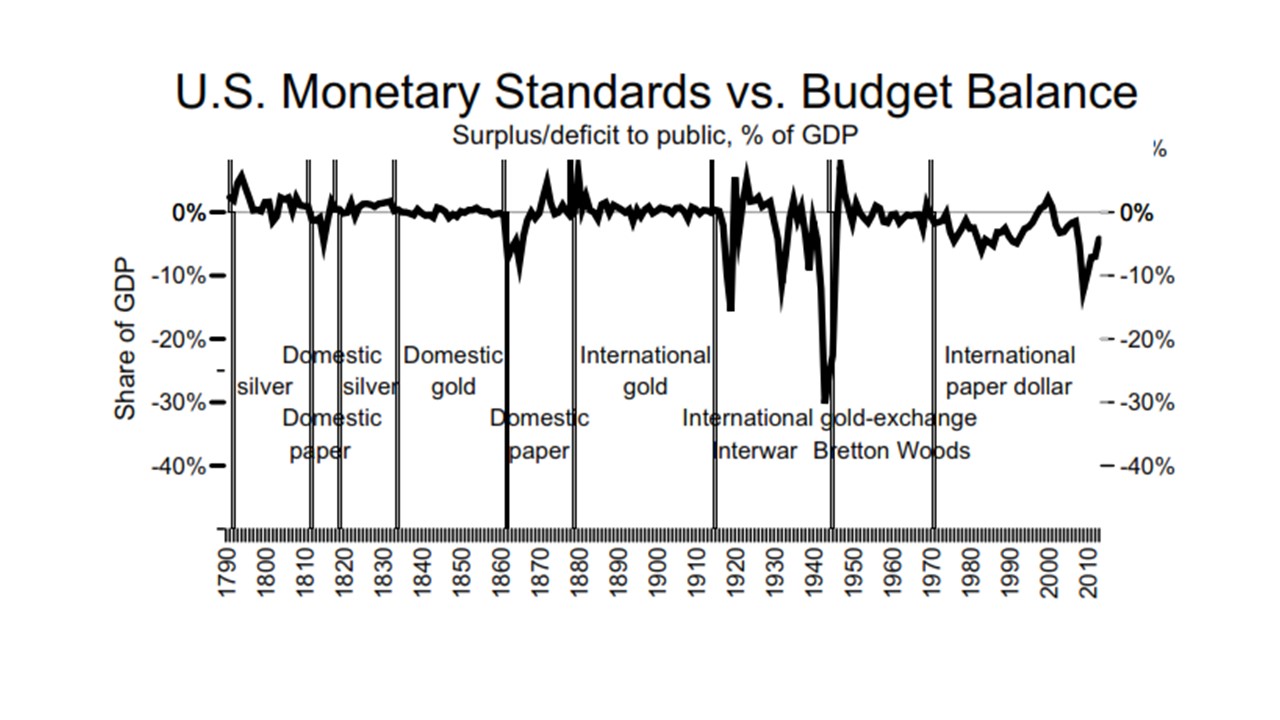

As a factual matter, in American history, a precious-metal standard has prevented monetary authorities from monetizing federal budget deficits. From 1790 to 1970, under a metallic standard (always gold and/or silver), the federal government averaged an annual surplus of 0.4% of GDP. During periods of paper money from 1790 to 2015, there has been an average deficit of 2.7% of GDP. To show that the monetary standard is the cause, I also compare summary numbers for federal with state governments, since under the Constitution the latter cannot issue inconvertible paper money. From 1979 to 2015 at the same time—therefore, under exactly the same economic conditions— as the federal government was running deficits averaging 3% of GDP, state governments averaged deficits of only 0.3% of GDP. This was not because state legislators are smarter or more virtuous than members of Congress, but rather because state governments are prevented from printing money to finance their budgets (as the American colonial governments frequently did).

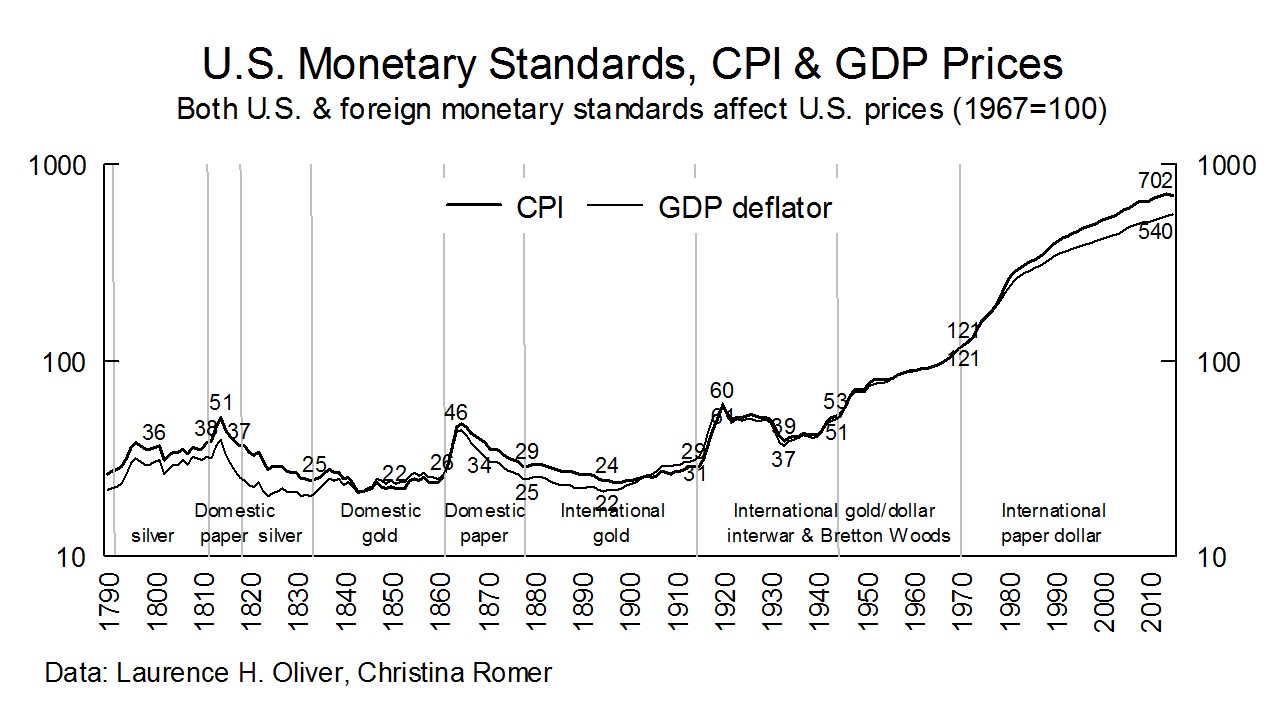

Since inconvertible paper money permits financing of federal budget deficits, there has been serious inflation (or, for that matter, deflation) only with paper money. This slide shows the Consumer Price Index and GDP Price index since 1790, As you can see, episodes of serious inflation (or deflation) in American history occurred only with paper money.

But the U.S. price level is affected not only by whether the dollar has been on a paper or metallic standard. Both domestic and foreign inflation are affected also by whether the dollar has been used by other counties to back their own currencies, as gold was used to back domestic currencies including the U.S. dollar before the First World War The U.S. dollar became an official reserve currency during the First World War, but officially became the world’s reserve currency as the result of the Bretton Woods agreement of 1944.

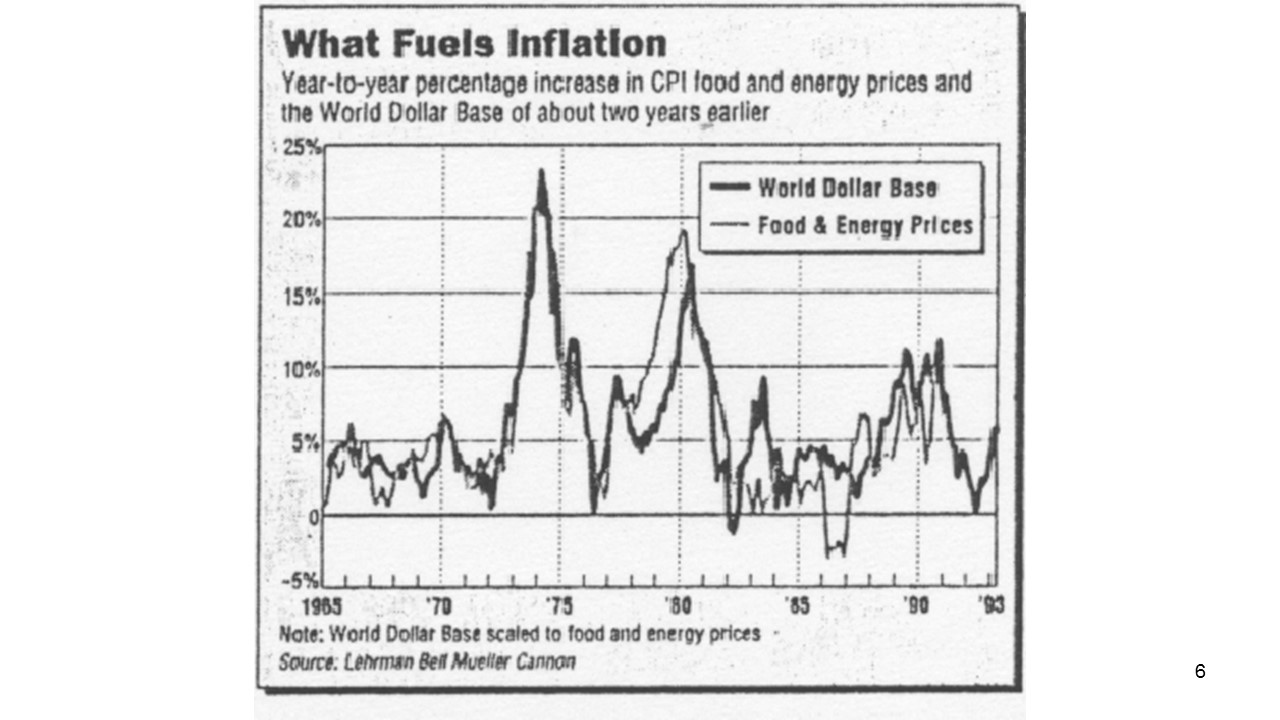

This slide is a bit grainy, because it comes from a 1991 Wall Street Journal op-ed article. It shows how at LBMC (originally Lehrman Bell Mueller Cannon, Inc., named after the principals), we implemented the great French economist Jacques Rueff’s ideas to predict in real time episodes of commodity-led inflation, the first being the inflation of 1989-91 and the 1991-92 recession, which resulted from the Federal Reserve’s response to that inflation. The slide shows that the World Dollar Base (the sum of the U.S. domestic monetary base and foreign official dollar reserves) has been an excellent predictor of commodity inflation, particularly food an d energy price inflation, in dollar terms.

Having given up after several years of trying to persuade U.S. policy-makers to change the world monetary system, four of us with connections to Jack Kemp (Lew Lehrman, Jeff Bell, I, and Frank Cannon) formed a business to predict the consequences of the inevitable economic policy mistakes. Most of our clients were money managers (banks, insurance companies, mutual and hedge funds) but also some governments.

The chart compares the growth of the World Dollar Base, lagged about two years, and its ultimate impact on food and energy price inflation. In that case, the surge in foreign official dollar reserves occurred in 1986-1988, as the mostly unanticipated consequence of the Plaza Accord of 1985, about which Jim Baker spoke in such glowing terms in the video we saw earlier this morning. In response to the dollar’s decline, foreign central banks, led at the time by the Bank of Japan, purchased massive amounts of U.S. dollar securities (mostly U.S. Treasury debt), to try to stem the rise of their currencies against the dollar. The result, as the chart shows, was the 1989-91 inflation and 1991-92 recession, which ended the presidency of George H.W. Bush in 1992.

In this way, we also were able to short-circuit what until then had been a purely theoretical debate about economic policy, particularly about the negative impact on the U.S. and the rest of the world of the Triffin Dilemma, by submitting those theories to test by the facts.

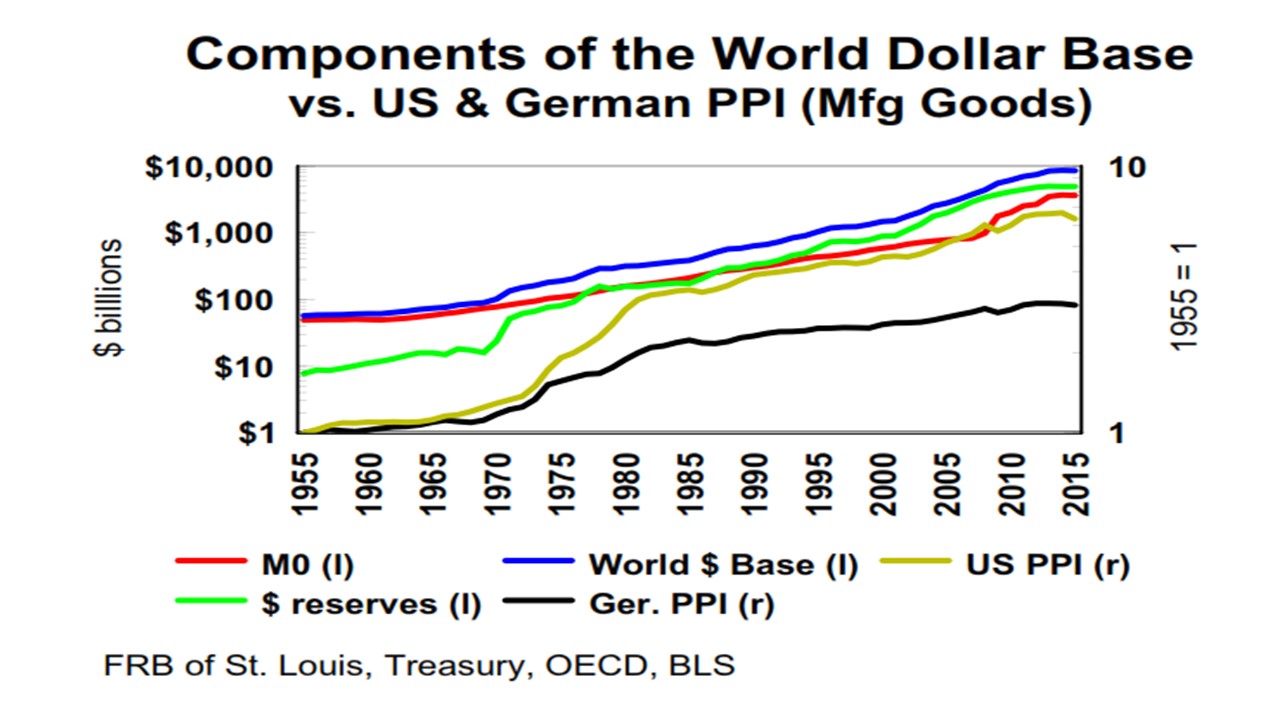

While the 1991 chart from the Wall Street Journal shows that growth of the World Dollar Base affects world commodity prices in dollar terms simultaneously (and therefore prices in any countries whose currencies are tied to the dollar), the next chart shows that prices rise faster and farther in the reserve-currency country itself than in other countries. This chart ran a few months ago in a Wall Street Journal op-ed article. The green, red and blue lines show the components and total value of the World Dollar Base on the left scale, while the black and gold lines compare producer prices for manufactured goods in the U.S. (gold) and Germany (black) on the right scale. I chose Germany rather than, say, China, because it has the longest consistent series, which cover the last 15 years of Bretton Woods and everything since, which included both fixed and floating exchange rates without gold convertibility. As the chart shows, while the price of German manufactured goods roughly tripled from 1955 to 2015, the price of American manufactured goods has more than sextupled.

The Triffin Dilemma is the inherent conflict of a reserve-currency country’s domestic policy with international monetary order. Those hieroglyphics at the end of certain sentences are economic formulas. They indicates that under the international gold standard, there was no Triffin Dilemma, because the whole world ran a trade surplus with itself, which was equal to the net increase in monetary gold.

The essence of the Triffin Dilemma is that any reserve-currency system is unsustainable, because reserves are bought and repayable in goods. This means that the net increase in foreign official dollar reserves must equal the net exports of the rest of the world—which in turn must equal the deficit in U.S. net exports.

The trade balance of any country must equal the net value of that country’s saving over investment. That’s the accounting identity which Steve Hanke mentioned earlier. There is nothing necessarily alarming in a trade deficit in itself. Despite tariffs (often high ones), the United States ran current account deficits totaling 69% of GDP from 1790 to 1895—because U.S. investment exceeded domestic saving by that amount. From 1896 to 1970, U.S. current account surpluses totaled 116% of GDP, because U.S. national saving exceeded investment by that amount. However, from 1971 through 2015, U.S. current account deficits totaled 93% of GDP because of the Triffin Dilemma: The increase in official dollar reserves must equal the rest of the world’s surplus (and America’s deficits) in net exports.

The trade balance of any country must equal the net value of that country’s saving over investment. That’s the accounting identity which Steve Hanke mentioned earlier. There is nothing necessarily alarming in a trade deficit in itself. Despite tariffs (often high ones), the United States ran current account deficits totaling 69% of GDP from 1790 to 1895—because U.S. investment exceeded domestic saving by that amount. From 1896 to 1970, U.S. current account surpluses totaled 116% of GDP, because U.S. national saving exceeded investment by that amount. However, from 1971 through 2015, U.S. current account deficits totaled 93% of GDP because of the Triffin Dilemma: The increase in official dollar reserves must equal the rest of the world’s surplus (and America’s deficits) in net exports.

In other words, the first period’s U.S. trade deficits reflected private foreign investment in the United States, which had a growing population requiring more domestic investment than could be financed by domestic American savings, and the second period’s trade surpluses equaled the excess of U.S. saving over investment. But the final period’s trade deficits were the necessary counterpart to the rest of the world’s accumulation of official dollar reserves, which are lent by/borrowed from foreign monetary authorities, not private foreign investors. That last period illustrates, in fact epitomizes, the “Triffin Dilemma.”

There are, and have always been, three main alternative solutions to the Triffin Dilemma, whether in the 1920s, in 1983, and today:

First, muddle along under the “dollar standard” until its eventual, inevitable collapse—a position now supported by some resigned foreigners and nostalgic Americans

Second, turn the International Monetary Fund into a world central bank issuing paper (e.g., special drawing rights) reserves—as proposed in 1943 by Keynes, since the 1960s by Robert A. Mundell, and in 2009 by Zhou Xiaochuan, governor of the People’s Bank of China.

Main drawback: This kind of standard is highly political and the allocation of special drawing rights essentially arbitrary, since the IMF produces no goods. If you think it is hard to reach agreement in individual countries, like the United States, France, or Russia, that problem would be cubed in achieving agreement even on an unworkable SDR standard.

Third, adopt a modernized international gold standard, as proposed in the 1960s by Rueff, since then by his protégé Lewis E. Lehrman, and in 1984 and during his 1988 presidential campaign, by Jack Kemp.

Arthur Conan Doyle’s detective Sherlock Holmes used to remark that once you have eliminated the impossible, what remains, however improbable, is the truth. After sifting the arguments and facts, I concluded more than three decades ago, and remain convinced, that the final option, a multilateral gold standard, is the only solution to the Triffin Dilemma which has worked, and can still work, in the real world.