Published January 25, 2017

Neither President Trump nor any of his economic advisers appear to have heard of, let alone be worried about, the Triffin Dilemma. But Mr. Trump’s economic and trade policies will fail unless he finds a solution to the dilemma—the inherent incompatibility, in a reserve-currency country, of domestic policy with the international monetary order.

A gold or other precious-metal standard prevents the financing of budget deficits through the monetary system. When America had a gold or silver standard, the federal budget ran an annual surplus averaging 0.4% of gross domestic product; when it hasn’t, the average deficit has been 2.7%. Similarly, from 1979-2015, U.S. state governments—which cannot print money—averaged budget deficits of 0.3% of GDP, while in the same economy the federal deficit averaged 3.3%. There has been no long-term inflation under the gold or silver standard in American history; substantial inflation (or deflation) has occurred only with paper money.

The move away from precious metals began more than a century ago. John Maynard Keynes argued in 1913 that whether a monetary authority holds gold or foreign-exchange reserves “is a matter of comparative indifference.” Colonial India’s “Gold-Exchange Standard,” he wrote, “far from being anomalous, is in the forefront of monetary progress” toward what he called “the ideal currency of the future.” British experts succeeded in promoting foreign-exchange reserves at the 1922 Genoa Conference, to forestall redemption of British World War I debts in gold. That ended the international gold standard born in Genoa in the 1440s, after the Hundred Years War.

(Click to enlarge image)

The French economist Jacques Rueff explained in 1932 why the gold-sterling-dollar standard had collapsed: With the creation of—for example—dollar reserves, purchasing power “has simply been duplicated, and thus the American market is in a position to buy in Europe, and in the United States, at the same time.” Hence the purchase of dollar reserves causes inflation (and the sale of dollar reserves, deflation) for countries with currencies tied to the reserve currency. Moreover, the credit duplication makes prices rise faster in the reserve-currency country, causing its goods to be uncompetitive and turning it from an international creditor to a debtor.

The post-World War II Bretton Woods gold-dollar-exchange standard broke down in 1968-71, for essentially the same reasons that had caused the interwar gold-sterling-dollar standard to collapse. Since 1971, international payments have been made chiefly in paper dollars.

Thus the Triffin Dilemma, named for Belgian-American economist Robert Triffin. National income (or output) is the sum of private consumption, private investment, government consumption, government investment, and net exports. Many economists wrongly assume that total world net exports must equal zero, but in fact countries participating in the international gold standard had combined net exports equal to the total increase in world gold reserves (which in turn approximated world gold exports). As a result, world monetary policy was countercyclical: When the prices of other goods fell, the profitability of gold mining rose.

Triffin showed that a monetary system based on a reserve currency is unsustainable, since foreign official dollar reserves (for example) are acquired and must be repaid in goods. In other words, the increase in official dollar reserves equals the net exports of the rest of the world, which means it must also equal U.S. international payments deficits—an unsustainable situation.

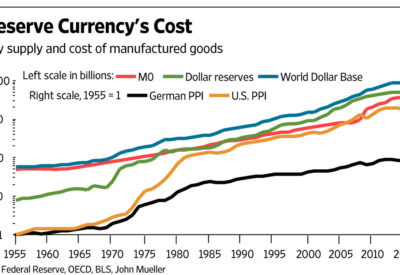

As the nearby chart shows, the cost of German manufactured goods has roughly tripled since 1955, but the cost of American manufactured goods has more than sextupled. That is why U.S. trade and budget deficits will be impervious to any Trump administration “deals” that focus on trade rather than monetary reform.

There are three main alternative solutions to the Triffin Dilemma:

First, muddle along under the current “dollar standard,” a position supported by resigned foreigners and some nostalgic Americans—among them Bryan Riley and William Wilson at the Heritage Foundation and James Pethokoukis at the American Enterprise Institute.

Second, turn the International Monetary Fund into a world central bank issuing paper (e.g., special drawing rights) reserves—as proposed in 1943 by Keynes, since the 1960s by Robert A. Mundell, and in 2009 by Zhou Xiaochuan, governor of the People’s Bank of China. Drawbacks: This kind of standard is highly political and the allocation of special drawing rights essentially arbitrary, since the IMF produces no goods.

Third, adopt a modernized international gold standard, as proposed in the 1960s by Rueff and in 1984 by his protégé Lewis E. Lehrman, writing on this page, and then-Rep. Jack Kemp.

The stakes are high. The Great Depression began with the collapse of the interwar monetary system in 1929-32, aggravated by the trade war that America’s Smoot-Hawley tariff triggered. Ironically, if Mr. Trump ignores the Triffin Dilemma, he will perforce promote the cosmopolitan crony capitalism by which the Clinton Foundation stuffed itself with so much cash from America’s client-states.

Mr. Trump’s own nostrum of trade protectionism is an understandable but easily exploded fallacy. The current account (the broadest measure of the trade balance) must equal the excess of national saving over investment. Therefore, while tariffs can curb imports, they cannot increase the trade balance, because they don’t affect the saving-investment balance; instead, they cause the currency to rise and exports to fall.

From 1971 through 2015, U.S. current account deficits totaled 93% of GDP because of the Triffin Dilemma: The increase in dollar reserves must equal the rest of the world’s surplus (and America’s deficits) in net exports. Perhaps it would take a deal-maker in Alexander Hamilton’s league to end the exorbitant burden of the dollar’s reserve-currency role and replace it with the only monetary standard that has worked in American or world history: gold.

Mr. Mueller directs the economics and ethics program at the Ethics and Public Policy Center.