Published February 17, 2016

House of Dialogue, Saint Ignatius Jesuit College, Budapest, Hungary

(Click on this image and other images on this page to expand)

I’d like to thank Fr. Szabolcs Sajgó, S.J., the Director of the House of Dialogue at the Saint Ignatius College here in Budapest, for hosting this discussion of the themes in my book Redeeming Economics, which is being published tomorrow in Hungarian by the Mathias Corvinus Collegium. I’m especially grateful to my friend, His Excellency János Csák, Hungary’s former ambassador to the United Kingdom, who is moderating the discussion. János Csák is a real Renaissance man. Besides being a successful man of business and former ambassador, he translated the book, together with philosopher Zoltán Abraham.

János also suggested that the topic of my remarks this evening be the same as of the first section of Redeeming Economics: “The Birth, Death, and Resurrection of Economics.”

I was pleased but also greatly surprised to learn that Father James V. Schall, S.J., whom I consider the greatest living Catholic thinker, included Redeeming Economics in his library of 20 modern books expressing what he calls the “Catholic intelligence.”[1]

But I should explain that this is not a book only for Roman Catholics. As I note near the start of Redeeming Economics, “Like natural law philosophy itself, economic theory is the product of human reason reflecting on common human experience, and that is the approach followed throughout this book.”[2] The natural law was developed in the Middle Ages by religiously orthodox Catholic, Jewish & Muslim scholars building on Aristotle’s foundations, and rediscovered by Protestants and Catholics after the Thirty Years War, about a century before the American Founding, for a similar reason: to discuss their profound differences without killing one another.

I’d like to accomplish three things this evening.

First, I’d like to offer “a brief, structural history of economics,” to explain how the logical and mathematical structures of scholastic, classical, and today’s neoclassical economics differ fundamentally.

Second, I’d like to discuss some of the practical applications of what I call “neo-scholastic” economics, which is offering new insights and policy solutions, focusing particularly on its refutation of the famous claim that legalizing abortion reduced crime, and on its explanation of “demographic winter”—the failure of advanced countries including the USA and Hungary—to reproduce themselves.

Finally, I’ll consider the world view implicit in scholastic, classical and neoclassical economic theory, which their chief exponents modeled on biblically orthodox natural law, Stoic pantheism, and Epicurean materialism, respectively.

- A Brief, Structural History of Economics

I must begin with a simple but widely overlooked fact: the logical and mathematical structures of scholastic, classical and neoclassical economics differ fundamentally. Yet few economists today are aware of the differences because American university economics departments, led by the University of Chicago in 1972, abolished the previous requirement that students of economics must master its history before being granted a degree. [3] This calls for a brief, structural history of economics.

What is economics about? As Jesus once noted—I interpret this as an astute empirical observation, not divine revelation—since the days of Noah and Lot, people have been doing, and until the end of the world presumably will be doing, four kinds of things. He gave these examples: “planting and building,” “buying and selling,” ‘marrying and being given in marriage,” and “eating and drinking” (Luke 18:27-28). In other words, we produce, exchange, give, and use (or consume) our human and nonhuman goods.

That’s the usual order in our action. But as St. Augustine first explained, the order is different in our planning. First we choose For Whom we intend to provide; next What to provide as means for those persons. [4] Finally, Thomas Aquinas latter added, we choose How to provide the chosen means, through production (always) and exchange (almost always), both of which Aristotle had described.

So, economics is essentially a theory of providence: it describes how we humans provide for ourselves and the other persons we love, using scarce means that have alternate uses. Human providence is a synonym for the cardinal virtue of prudence. Aristotle had divided moral philosophy into ethics and politics. But he also aptly described humans as “rational,” “conjugal,” and “political animals.” So Aquinas redivided moral philosophy into three, distinguishing personal, domestic, and political prudence—or equivalently, “economy”— according to the social unit described.

Scholastic ‘AAA’ economics[5] (c.1250-1776) began when Thomas Aquinas first integrated the four elements of production, exchange, distribution, and consumption, all drawn from Aristotle and Augustine, into an outline of personal, domestic, and political economy, both positive and normative, within the natural law.[6] The scholastic outline was taught at the highest university level for more than five centuries by every major Catholic and (after the Reformation) Protestant economic thinker—notably Lutheran Samuel von Pufendorf, whose work was used by Adam Smith’s own teacher to teach Smith economics and was also highly recommended by Alexander Hamilton.[7]

Classical economics (1776-1871) began when Adam Smith cut the four elements to two, trying to explain specialized production (which he called “division of labor”) by production and exchange alone. Smith and his classical followers undoubtedly advanced those two elements. But Smith also dropped Augustine’s theory of utility (which describes consumption) and replaced Augustine’s theory of personal distribution (gifts and their opposite, crimes) and Aristotle’s theory of domestic and political distributive justice with the mere (often false) assumption that everyone is always motivated purely by self-love.[8]

Neoclassical economics (1871-c.2000) began when three economists dissatisfied with the practical failure of Smith’s classical outline (Jevons 1871 in England, Menger 1871 in Austria, and Walras 1874 in Switzerland) independently but almost simultaneously reinvented Augustine’s theory of utility, starting its reintegration with the theories of production and exchange.[9] They abandoned Smith’s revised outline mostly for three related reasons: without the theory of utility classical economists were unable to answer some important questions (for example, why goods that can’t be reproduced with labor have value); made predictions about others that turned out to be spectacularly wrong (notably the “iron law of wages,” which predicted that rising population would prevent rising living standards); and directly fostered Karl Marx’s disastrously erroneous economic analysis. Though schools of neoclassical economics have since multiplied, all are derived from these three.

Neoscholastic economics (c.2000—). In my book, I predict that Neoscholastic economics will revolutionize economics once again in coming decades by replacing its lost cornerstone, the theory of distribution: simply because, as with the theory of utility, including the element does a far better job of empirical description.[10]

This historical analysis offers a framework for analyzing other schools of economics. I believe they show both what one can appreciate—but also the shortcomings—in each school, whether the British, Chicago, Austrian or Walrasian schools.. But I will leave these lesser differences to our discussion. In the notes to my paper I consider pairs of economist in each of the major neoclassical schools: Wilhelm Röpke and Ludwig von Mises for the Austrian School; Jacob Viner and George Stigler for the Chicago School; and G.K. Chesterton and Hilaire Belloc for the Distributist School. In each pair, the former filled gaps in the latter’s views, bringing it closer to the (Neo-) Scholastic theory.

Thus Adam Smith’s chief significance lay not in what he added to, but rather subtracted from economics. As Joseph Schumpeter (1954) demonstrated, “The fact is that the Wealth of Nations does not contain a single analytic idea, principle or method that was entirely new in 1776.”[11] The facts about the development of economics seem to indicate that a re-evaluation is overdue and quite likely for both Augustine and Adam Smith, particularly since Smith essentially “de-Augustinized” economic theory to its detriment. Though far from exhaustive, this brief structural history of economics explains why scholastic economics contained four, classical only two, and neoclassical economics three basic elements.

Positive scholastic theory. To explain the Two Great Commandments, Augustine had started from Aristotle’s insight that “every agent acts for an end” and his definition of love—willing some good to some person. But Augustine drew an implication that Aristotle had not: every person always acts for the sake of some person(s). For example, when I say, “I love vanilla ice cream,” I really mean that I love myself and use (consume) vanilla ice cream to express that love (in preference, say, to strawberry ice cream or Brussels sprouts, which reflects my separate scale of utility).

In other words, Augustine’s crucial insight is that we humans always act on two scales of preference—one for persons as ends and the other for other things as means: personal love and utility, respectively. Moreover, we express our preferences for persons with two kinds of external acts. Since man is a social creature, Augustine noted, “human society is knit together by transactions of giving and receiving.” But these outwardly similar transactions may be of two essentially different kinds, he added: “sale or gift.” Generally speaking, we give our wealth without compensation to people we particularly love, and sell it to people we don’t, in order to provide for those we do love. Since it’s always possible to avoid depriving others of their own goods, this is the bare minimum of love expressed as benevolence or goodwill and the measure of what Aristotle called justice in exchange. But our positive self-love is expressed by the utility of the goods we provide ourselves, and our positive love of others with beneficence: gifts. Hate or malevolence is expressed by the opposite of a gift: maleficence or crime.

Aristotle had bisected moral philosophy into ethics and politics. But scholastic philosophy and economic theory followed Thomas Aquinas by re-dividing them into three parts[12]: Hence the middle three sections of Redeeming Economics are devoted to personal, domestic, and political prudence, or “economy.”

- Practical Applications of (Neo-) Scholastic Economics

In each chapter, after re-stating and updating the scholastic economic theory, I focus on a salient practical application in which neoclassical and neoscholastic economics reach divergent empirical predictions.

IIa Refuting the Levitt-Donahue Thesis on Abortion and Crime.

For example, at the personal level, I disprove the famous claim by economist Steven D. Levitt, featured in his mega-bestseller Freakonomics, that the U.S. Supreme Court’s legalization of abortion in 1973 caused the crime rate to fall 15-20 years later, by eliminating potential criminals (Levitt and Dubner 2005, 117-144).

Actually, as I show, there is a 90% current, inverse relation between “economic fatherhood” and homicide. The data show that legalizing abortion raised crime rates both immediately and with a lag.

IIb. The “Neoscholastic” fertility model.

Turning to domestic economy, what I call “neoscholastic” economics differs from neoclassical economics by recognizing gifts as well as exchanges. Pervasive gifts are reflected in the systematic differences between income and consumption at each stage of life. Recognizing this fact also makes the “neoscholastic” fertility model much more accurate than existing neoclassical models. Just four factors explain most variation in birth rates among the 70 countries for which sufficient data are available (comprising about one-third of all countries, but more than three-quarters of world population).[13]

The birth rate is strongly and about equally inversely proportional to per capita social benefits and per capita national saving (both adjusted for differences in purchasing power), which represent provision by current adults for their own well-being.

When these factors are taken into account, a legacy of totalitarian government is also highly significant, reducing the birth rate by about 0.6 children per couple.

Finally, the birth rate is strongly and positively related to the rate of weekly worship. This is because all gifts of scarce resources—whether rearing a child or worshipping God—require the same lowering of self and raising of others in our scale of preferences for persons. On average throughout the world in 2005-10 (adjusted for differences in mortality), a couple which never worshipped had an average of 1.2 children; but the average couple which worshipped at least once a week had 2.4 more—an average of 3.6 children.[14]

There are four main reasons, then, for “demographic winter,” in order of importance: First, low rates of religious practice, which are associated with low birth rates (and high incidence of abortion); second, government benefits so high as to displace gifts within the family, particularly the gift of life—in effect substituting “benefits for babies”; third, legacies of totalitarianism; and finally, finally, heavy reliance on fiscal policies which penalize investment in people: so-called “human capital.”

Fifty years ago, the world’s three most populous countries were China, India, and the United States. That’s still true today. But the practice of abortion in China but not as widely in India is causing a reversal of their first and second population ranks.

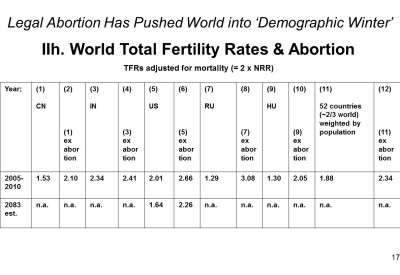

Adjusted for differences in mortality, in 2005-10 China’s TFR was 1.53 after but 2.10 before abortions; India’s 2.34 after and 2.41 before abortions, the USA’s 2.01 after but 2.66 before abortions, and 4th-largest Indonesia’s 2.04 after but 3.05 before abortions.[15] On the same basis Hungary’s morality-adjusted TFR was 2.05—almost exactly the replacement rate—before but 1.30 after legal abortion. Based on all 53 countries for which data are available (comprising about two-thirds of world population), the World TFR was 1.89 after, but 2.38 before abortions. Thus legal abortion has been single-handedly responsible for “demographic winter” in nearly all individual countries, including the USA and Hungary and for the whole world.

What does this mean for policy? Based on current projections, the U.S. federal budget would substantially increase federal social benefits as a share of GDP. Because of the strong inverse relation between per capita social benefits and the birth rate, I project that the U.S. birth rate will fall significantly farther under current law, from about 2.01 in 2005-10 (1.83 in the most recent year) to about 1.64 children per couple. These projections indicate that the budget is likely to shift U.S. society to conditions approximating the Social Security Trustees’ “High-Cost Assumptions.”

Like the United States, most countries of Europe, including most of Eastern Europe, have decisively substituted “benefits for babies.” In the USA, the figures for total social benefits are 13.2% in 1980, 13.5% in 1990, 14.5% in 2000, and 20.4% in 2010.[16] The figures for cash social benefits are not as high (because they exclude in-kind medical benefits), but benefits as a share of GDP have risen steadily both in the USA and with few exceptions, in most countries of Eastern Europe. Where abortion is legal, the willingness or failure to reform social benefits has direct consequences for the birth rate and national survival of any country.

III. The Three Basic World Views Expressed in Economic Theory

The notion that Adam Smith invented or is somehow indispensable to understanding economics might be called “Smythology” (with two y’s). By far the most influential piece of Smythology in the USA was Milton Friedman’s argument linking Adam Smith’s philosophy with the meaning of the American Declaration of Independence: “The story of the United States is the story of an economic miracle and a political miracle that was made possible by the translation into practice of two sets of ideas–both, by a curious coincidence published in the same year, 1776.” According to Friedman, “the fundamental principles of our system [are] both the economic principles of Adam Smith…and the political principles expressed by Thomas Jefferson.”[17]

Like many others I found Friedman’s argument persuasive, until I discovered that the “choice of 1776” was actually a divergence, not a convergence, and of three, not two world views. The third symbolically significant event of 1776 was the death of Smith’s dear friend, the Epicurean skeptic David Hume.

I noted earlier that (Neo-) Scholastic economics is essentially a theory of providence. It mostly describes human providence. But each of the three basic economic theories also entails a different theory of divine providence: the three approaches to economic theory express three distinct world views, the confrontation of which goes back nearly two millennia.

When the Apostle Paul preached in the marketplace of Athens, he prefaced the Gospel with a Biblically orthodox adaptation of Greco-Roman natural law. The evangelist Luke tells us that “some Epicurean and Stoic philosophers argued with him” (Acts 17:18). The same dispute has continued among scholastic, classical, neoclassical, and now neoscholastic economists.

In (neo-) scholastic natural law, economics is a theory of rational providence, describing how we “rational,” “matrimonial,” and “political animals” choose both persons as “ends” (which we express by our personal and collective gifts) and the scarce means to be used (consumed) by or for those persons, which we make real through production and exchange. By dropping both distribution (the choice of persons as ends) and consumption (the choice of other things as means), Smith expressed the Stoic pantheism that viewed the universe “to be itself a Divinity, an Animal”[18] with God as its immanent soul, so that sentimental humans choose neither ends nor means rationally; instead, “every individual…intends only his own gain…and is led by an invisible hand to promote an end which was no part of his intention.”[19] By restoring utility (the choice of means) but not distribution (the choice of persons as ends), neoclassical economics expressed the Epicurean materialism that claims humans somehow evolved as merely clever animals, highly adept at calculating means but having no choice other than self-gratification, since “reason is, and ought only to be, the slave of the passions,” as Hume put it.[20][21]

An autobiographical note

To close on an autobiographical note, perhaps I should describe briefly how I came to write the book.

I suppose it was the accident of my recovering from college atheism while becoming an economic forecaster. I had first read the “AAA’s”—Aristotle, Augustine, and Aquinas—in high school and college. But I had to return to them to puzzle through what I believed and why I believed it, as I realized that my atheism was logically untenable. That was mostly while I worked for then-Congressman Jack Kemp, as he persuaded President Ronald Reagan to adopt his economic ideas (and incidentally giving me free run of the Library of Congress).

Afterward, some colleagues and I started an economic and financial market forecasting firm, for which I crunched numbers for 26 years until January 2015. When I took time off to write the book, I found I had something to say that most economists don’t know—because, starting in 1972, economics departments at most universities abolished the previous PhD requirement that one must master the history of economics. The discipline of being a forecaster helped me realize that the logical and mathematical structures of Thomas Aquinas’s original scholastic economics, Adam Smith’s classical economics, and today’s “neoclassical” economics all differ fundamentally. And thanks to the “AAAs,” I had learned more economic theory than is taught in modern economics—the main difference being what the book’s subtitle calls “the missing element,” which describes our interpersonal relations of love and hate—at the personal level gifts (and their opposite, crimes) and at the domestic and political levels, what Aristotle called “distributive justice.”

As I have said, Redeeming Economics presumes only the natural law: what we can know by reasoning from common experience. Though comprising the largest single religious denomination, Roman Catholics make up less than one quarter of the U.S. population. But as I will note later this week at a conference co-sponsored by KETEG (Christian Social Principles in Economy), (neo-) scholastic economics also provides the analytical “toolkit” necessary to understand and explain Catholic social doctrine.

As historian of economics Henry William Spiegel noted of the “marginal revolution” that ended classical and launched neoclassical economics in the 1870s, “Outsiders ranked prominently among the pioneers of marginal analysis because its discovery required a perspective that the experts did not necessarily possess.”[22] I don’t underestimate the time or effort it will take. But I predict that in coming decades, neoscholastic economists, building on the original scholastic outline, will supersede neoclassical economists for exactly the same reason the latter quickly supplanted classical economists starting the in 1870s: It’s not that economists will draw back in horror at the moral implications of their current theory. Rather, having one more indispensable explanatory element, their new theory will be both more comprehensive and empirically more accurate.[23]

[1] Schall (2016).”On Catholic Intelligence,” Crisis Magazine, 3 February. http://www.crisismagazine.com/2016/on-catholic-intelligence.

[2] Redeeming Economics, 3.

[3] This change culminated a long campaign that George J. Stigler had started in 1955. “In 1972, he [Stigler] successfully proposed that the history of thought requirement be dropped at Chicago. Most other economics departments later followed suit…At the same meeting Stigler unsuccessfully proposed that the economic history requirement also be dropped.” Leeson (1997), endnote 62. Leeson (1997) was subsequently incorporated into Leeson (2001). In his campaign for the change, Stigler rejected Aquinas’ view that a scientist is defined by whether he understands his subject rather than having a degree. Stigler claimed instead that every science is continuously defined by a self-governing elite calling themselves scientists. From this sociological definition, Stigler said it was obvious that “one need not read in the history of economics—that is, past economics—to master present economics.” Instead, “the young theorist…will assume…that all that is valid in earlier work is present—in purer and more elegant form—in the modern theory,” and that “the history of the discipline is best left to those underendowed for fully professional work at the modern level.” But as the text indicates, the young economist who assumed this would be underendowed for fully professional work because he wouldn’t know his subject. (Stigler, 1969, reprinted in Stigler, 1982, p. 107).

[4] Among prominent modern economists, only Jacob Viner (1978) seems correctly to have identified Augustine’s main technical contribution to economic theory, distinguishing separate scales of preference for persons (love and justice) and non-persons (utility), and both of these from the absolute metaphysical scale of being: Augustine deals “simultaneously with three scales of value, relating to order of nature, utility, and justice.” Viner (1978), p. 55.

[5] In his otherwise magisterial History of Economics Analysis, Schumpeter (1954) incorrectly wrote that Augustine “[n]ever went into economic problems” (p. 72) and Aquinas’ economics was “strictly Aristotelian.” (p. 93). As we’ll see, Aquinas not only combined Aristotle’s contributions with but also subordinated them to Augustine’s, in both “positive” or descriptive and “normative” or prescriptive theory.

[6] On Augustine’s theory of personal distribution, see Augustine (396/397) and Augustine (395/396), cited below; Aristotle’s social distribution (distributive justice): Ethics V,3 in Aristotle 1954 (350 BC); Augustine’s theory of utility (consumption): City of God XI,16 in Augustine 1984 (413-426-427); Aristotle’s theory of production of people and property: Politics I,4 in Aristotle 1962 [c. 350 BC]; Aristotle’s justice in exchange (equilibrium): Ethics V,5. In Aquinas, three of these four elements (the distribution function, the utility function, and the equilibrium conditions) are described (and the production function implied) in Aquinas 1993 [1271-1272]. Personal distribution: Book V Lectures IV-IX, pp. 293-318; social distribution: p. 294; the “equilibrium conditions”: pp. 294-296 and pp. 297-299, the “utility function” and analysis of money, pp. 312-315. The production function is described in his commentary on Aristotle’s Politics I, 1-3: Aquinas 2007 [1271-1272]. The same analysis is also scattered throughout his Summa theologiae in Aquinas 1981 [1271-1272], especially in his commentary on the seventh commandment.

[7] According to Ross (1995, pp. 53-4), Adam Smith’s teacher Frances Hutcheson taught him from an annotated edition of Pufendorf (1991 [1673]). As with Aquinas and the earlier scholastics, Pufendorf’s Protestant version of the natural law contains all four basic elements of economic theory, organized according to personal, domestic and political economy, and integrating prescriptive with descriptive theory by the Two Great Commandments. Personal distribution, Pufendorf, (1991 [1673]), pp. 64-67; social and political distribution, ibid., p. 32 and pp. 61-63; utility, ibid. pp. 94-96; production of and by human and nonhuman factors, ibid., pp. 84-89; society organized around family household, ibid., pp. 120-131; justice in exchange or equilibrium equating product values and factor compensation, ibid., p. 31 and pp. 94-95. The Two Great Commandments integrating description and prescription. Ibid., 11-12. The fact that Pufendorf was a Lutheran who wrote a critical history of the Catholic Church and that his theories were taught at the Calvinist University of Glasgow demonstrates that the scholastic outline of economic theory was broadly known and accepted. Pufendorf was widely read in the American colonies and recommended by Hamilton (1775). Hamilton had penned two-thirds of the Federalist papers and as first Treasury Secretary would reject Smith’s specific economic advice in the Wealth of Nations to the United States (Smith (1966 [1776]), Book II, Ch. 5); Hamilton (1791).

[8] By adopting special assumptions that are often empirically false, Smith altered the meaning of “distribution” and conflated two elements recognized in the scholastic system as distinct: distribution proper and justice in exchange. Smith’s elimination of Augustine’s theory of personal distribution from the outline of economic theory is signaled in the passage that includes his famous declaration: “It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own interest. We address ourselves not to their humanity but to their self-love, and never talk to them of our necessities but of their advantages.” Smith (1966 [1776]) I, II: Vol. I, p. 17. In Augustine’s theory, the main reason the brewer or baker doesn’t serve his customers from beneficence is not exclusive self-love, but rather that each is faced with the fact of scarcity: If the baker shared his bread equally with every customer instead of charging for it, he would leave himself and his family too little to live on. Augustine’s theory also explains why the brewer or baker shares with his family or friends but not with his business customers: he loves his customers only with benevolence (wishing good to them) but his family with both benevolence and beneficence (doing good to them). He sells his product to customers to earn the means to provide for himself and the rest of his family. Augustine’s theory of personal distribution explains the essential difference between a gift and an exchange, and provides a measure of how far each of us actually is motivated by self-love and how much by love of neighbor. Smith fails to grapple with the fact that charitable behavior simply does not fit into a theory that reduces all human transactions to exchange and self-love. He never explains why the butcher’s customers never expect their dinner from his beneficence, yet his friends sometimes and his children always do.

[9] Jevons (1871); Menger (1871); Walras (1874).

[10] What the distributists grasped clearly, as classical and neoclassical economists who opposed them usually did not, is that a broad distribution of productive property is a prior condition, not the inevitable outcome, of a properly functioning market economy, for which vigorous regulation against monopoly is necessary.

[11] Schumpeter (1954), p. 184.

[12] Aquinas, T. (1981 [1265-72]) II-II Q47 A11 contra and corpus, http://www.newadvent.org/summa/3047.htm#article11, and Q50 A3, http://www.newadvent.org/summa/3050.htm.

[13] The model was first published in John D. Mueller, “How Does Fiscal Policy Affect the American Worker?” Notre Dame Journal of Law, Ethics and Public Policy Vol. 20 No. 2 (Spring 2006), 563-619; available at http://www.eppc-stage.local/publications/pubID.2671/pub_detail.asp

[14] Regular worship is not only positively related to fertility in a roughly linear fashion. It is also inversely related to the incidence of abortion, which (like crime in general) rises exponentially as the rate of worship declines. Data on abortion rates by country from “Abortion statistics and other data,” by Wm. Robert Johnston. Last updated 19 September 2015, available at http://www.johnstonsarchive.net/policy/abortion/

[15][15] Fertility rates should be adjusted for differences in mortality rates. The Net Reproduction Rate (NRR) represents a hypothetical woman whose experience matches the average rates of fertility and death of all women in a given year. (The Total Fertility Rate measures fertility alone.) An NRR of 1.00 indicates that each woman bears exactly one surviving daughter. The Total Fertility Rates used in the model equal twice the NRR. For example, the TFR in Mali in 2006 was 7.42, but the NRR was 1.987, which corresponds to a TFR of 3.97 children per couple. In other words, in Mali the typical couple had about 3-1/2 children simply to compensate for the likelihood of premature death before reaching child-bearing age. United Nations, Department of Economic and Social Affairs, Population Division, World Population Prospects: The 2008 Revision, New York, 2009; http://data.un.org/Data.aspx?d=PopDiv&f=variableID%3A48.

[16] Adema, W., P. Fron and M. Ladaique (2011), “Is the European Welfare State Really More Expensive?: Indicators on Social Spending, 1980-2012; OECD Social, Employment and Migration Working Papers, No. 124, OECD Publishing. http://dx.doi.org/10.1787/5kg2d2d4pbf0-en; Table A.I.1.3: Public social expenditures as % GDP, 1980 – 2012, estimated for 2008 to 2012, p. 41.

[17] Friedman, M., and Friedman, R. (1979), 1-2.

[18] Smith (1982 [1795]), para. 274.

[19] Smith (1966 [1776]), Bk. IV Ch. 2; Vol. 2, p. 35.

[20] Hume 1740, II, III, iii,. Though this worldview is usually ignored or left implicit, a few economic thinkers have worked out this view of human action explicitly and systematically. One of the most influential was the Austrian economist Ludwig von Mises (1881-1973). According to Mises, “Action is based on reason, action therefore which is understood by reason, knows only one end, the greatest pleasure of the acting individual. The attainment of pleasure, the avoidance of pain—these are its intentions.” He added that pleasure or satisfaction must be construed broadly enough to embrace all action: “The modern concept of pleasure, happiness, utility, satisfaction and the like includes all human ends, regardless whether the motives of action are moral or immoral, noble or ignoble, altruistic or egotistical.” Mises, Socialism, II.5.6, available at http://www.econlib.org/library/Mises/msS3.html#Part%20IICh.5. But if we accept this premise, it follows that all human action is a kind of exchange: “All human action, so far as it is rational, appears as the exchange of one condition for another. Men apply economic goods and personal time and labour in the direction which, under the given circumstances, promises the highest degree of satisfaction, and they forego the satisfaction of lesser needs so as to satisfy more urgent needs. This is the essence of economic activity—the carrying out of acts of exchange.” Ibid., II.5.9. Even the actions of an isolated individual, according to Mises, are a form of exchange: an exchange of one state of pleasure for another that he values more highly: “It is true that if an isolated man is ‘exchanging’ labour and flour for bread within his own house, the considerations he has to take into account are not different from those which would govern his actions if he were to exchange bread for clothes on the market. And it is, therefore, quite correct to regard all economic activity, even the economic activity of isolated man, as exchange.” Ibid., II.5.18. Moreover, it follows from the same theory that humans have no choice about the persons they choose as the end of their actions. “The power to choose whether my actions and conduct shall serve myself or my fellow beings is not given to me,” Mises maintained: Ibid., IV.27.7 http://www.econlib.org/library/Mises/msS10.html#Part%20IVCh.29. Presumed to have no choice of persons as ends, humans are therefore presumed to arrange all goods on a single comprehensive scale of preference, rather than on separate scales for persons as ends and other things as means, as in Scholastic economics: “Unity of action can exist only when all ultimate values can be brought into a unitary scale of values,” Ludwig von Mises, Socialism, IV.27.13, available at http://www.econlib.org/library/Mises/msS10.html#Part%20IVCh.29. According to Mises, “Nothing that men aim at or want to avoid remains outside of this arrangement into a unique scale of gradation and preference”: Mises, L. (1996 [1949]) p. 1; http://www.mises.org/humanaction/introsec1.asp#p1, accessed 28 March 2008.

[21] In 1922 Mises condemned Scholastic economics and modern Christian social reform as irremediable “state socialism,” singling out Leo XIII, Pius XI, and above all Pesch for obloquy: “The protagonists of Christian social reform as a rule do not regard their ideal Society of Christian Socialism as in any way socialistic. But this is simply self-deception. . . . Where private property exists, only market prices can determine the formation of income. To the degree in which this is realized, the Christian social reformer is step by step driven to Socialism, which for him can be only State Socialism.” Mises, L., (1981 [1922]), II.15.33. The premise of Mises’s assertion, “Where private property exists, only market prices can determine the formation of income” is wrong because of the usually false assumption that any goods produced and exchanged, e.g., by a head of household, are consumed by that person. Though usually implicit, Mises made this assumption explicit when he wrote, “Where each household is economically self-sufficient, the privately owned means of production exclusively serve the proprietor. He alone reaps all the benefits derived from their employment,” Mises, L. (1996 [1949]), Human Action, 683–84, http://www.mises.org/humanaction/chap-24sec4.asp,

[22] Spiegel (1971), p. 507.

[23] Other than Viner (1978), few academic economists so far have recognized the systematic differences between classical, neoclassical, and neoscholastic economics. An important recent exception is Aguirre, 2006; see also Aguirre, 2004. Also deserving special mention for insights drawn from scholastic theory are Worland (1967), Chafuen (1986), Chafuen (1993), Morse (2001), Piedra (2004) and Yuengert (2004). Aguirre and Morse have begun the necessary rewriting of the neoclassical economic theory of the family. Though similarly inspired by scholastic theory, Mueller (1996) was still formally neoclassical. Warning to theologians: “neoscholastic” has nearly opposite meanings in theology and economics. In 19th and 20th Century theology it essentially meant equating Aquinas with Aristotle and removing, Augustine’s fundamental insight that all persons (human or divine) are motivated by love for some person(s), and all personal love is expressed with a gift. In 21st Century economics “neoscholastic” theory restores that insight to its central role.

John D. Mueller is the Lehrman Institute Fellow in Economics and Director of the Economics and Ethics Program at the Ethics and Public Policy Center.